Delta Neutral Option Strategies

Delta neutral trading is employed to mitigate the portfolio's exposure to market risks. It is a non-directional strategy, meaning the potential profit does not depend on the direction of the base asset's price. Essentially, the strategy uses a combination of various positions which neutralize each other. This approach is particularly advantageous in unpredictable markets or for hedging against minor price shifts in established positions.

What Is Delta Neutral?

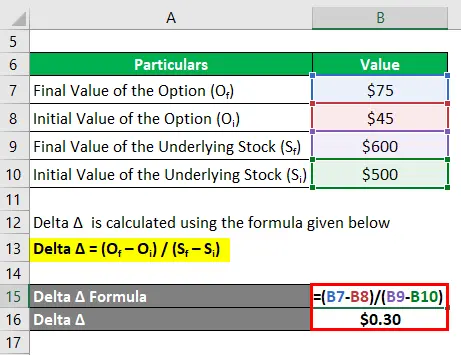

Delta, Δ, is a pivotal Greek in the arsenal of options traders. It gauges a derivative’s price sensitivity to a 1 point change in the base asset's price. The values it can take depend on the type of the option: from 0 to 1 for calls, and from 0 to -1 for puts.

A portfolio is referred to as delta neutral when all its positions in aggregation result in a delta sum of zero. This equilibrium is sought to buffer the portfolio against minor price oscillations in the base asset.

Key Takeaways

- A strategy is considered delta neutral when the aggregated delta of all the position held is zero, or approaching zero.

- The aim of the strategy is to reduce the impact of the minor price shifts on the portfolio.

- Continual portfolio rebalancing is necessary to preserve delta neutrality amidst changes in the market.

Option Positions vs Option Greeks Signs

Greeks are sensitivities of the option price with respect to some parameter. They are vital tools that measure different risk factors.

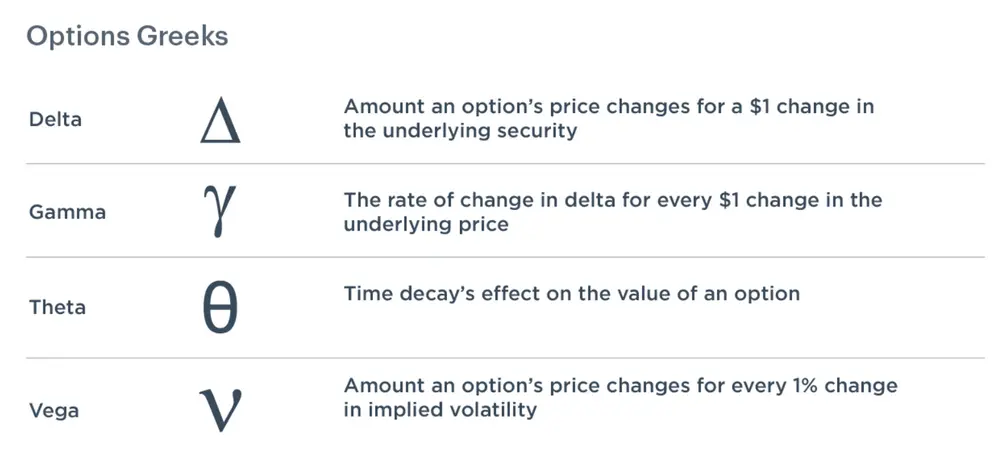

As we’ve already mentioned, Delta quantifies the expected price change of a derivative for a 1 dollar movement in the base asset. The asset can be stock, crypto, commodity, etc. Gamma measures delta's rate of change, offering insight into stability. Theta tracks the loss of value as time passes. Vega shows sensitivity to volatility.

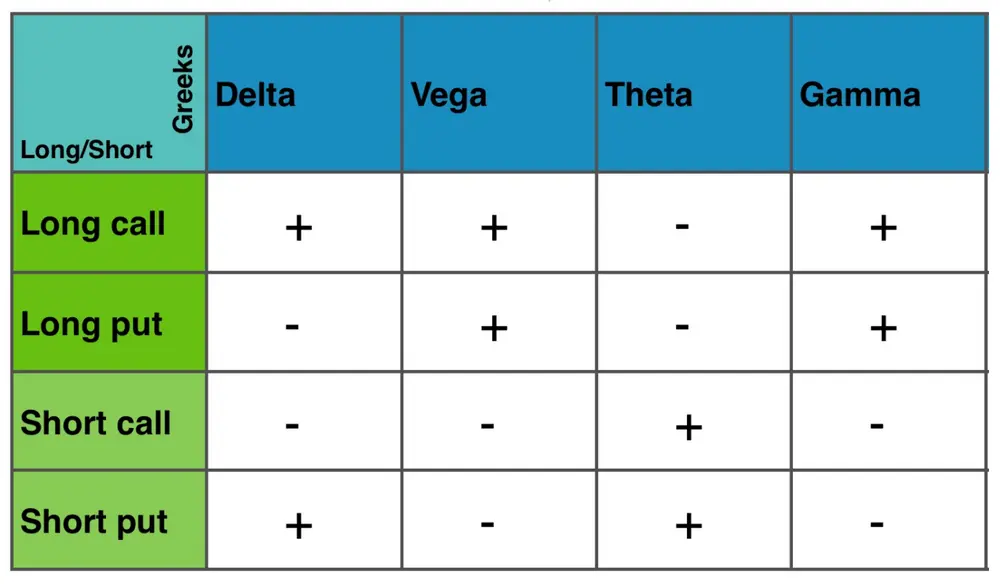

The sign of the Greek for each option will depend on the side of the trade and type of the option. The general framework is provided below. Remember that buyers enter long positions, while sellers enter the short ones.

As we can see from the table above, a long call has a positive delta. That is, its price increases together with the increase in the base asset's price. Let’s say a call option on Apple stock (AAPL) has a delta of 0.5. It would signify that the price of a contract may rise by approximately 50 cents for each dollar increase in AAPL.

Conversely, a long put has a negative delta, gaining in value when the base asset's price decreases. A put option on AAPL with a delta of -0.5, for example, is supposed to increase by 50 cents for each dollar AAPL falls.

A positive delta for a short put indicates that the position's value will increase as the base asset's price increases. If the asset's price goes up, it becomes less likely that the put will be exercised. The reason is that the buyer of the put would not want to sell the asset at a lower strike price when they can sell it at a higher market price. Thus, the option becomes less valuable. As a result, the seller of the put benefits from an increase in the base asset's price.

However, it's important to note that the Greeks are theoretical constructs based on models that operate on assumptions. They are not guarantees, but estimations that can help traders make more educated decisions about their trades.

What Is the Delta Neutral Option Strategy?

The delta neutral strategy is crafted to forge a portfolio impervious to slight price movements of the base asset. It meticulously offsets the portfolio's positive, as well as negative deltas to hover around a net-zero delta.

In practice, this method may involve holding both call and put contracts on the same asset. As previously discussed, options have deltas ranging from -1 to 1, influenced by their type and position in the market.

Beyond option contracts, the strategy can incorporate the asset itself. Owning the asset outright assigns a delta of +1, directly linking the position's value to the asset's price movement. Conversely, a short sale of the asset carries a delta of -1, inversely affecting the position's value with the asset's price change.

How Is Delta Neutral Calculated?

One must balance the portfolio deltas to nullify each other in order to maintain delta neutrality. For instance, if a trader's combined delta is +150, they must establish counter positions summing to -150 delta. This equilibrium is dynamic, necessitating ongoing recalibration as deltas fluctuate with market prices, time decay, and volatility.

Delta is typically calculated using an options pricing model, such as the Black-Scholes formula or a binomial model. These models take into account several factors, including the price and volatility of the base asset, the strike of the option, the time to maturity, and the risk-free interest rate.

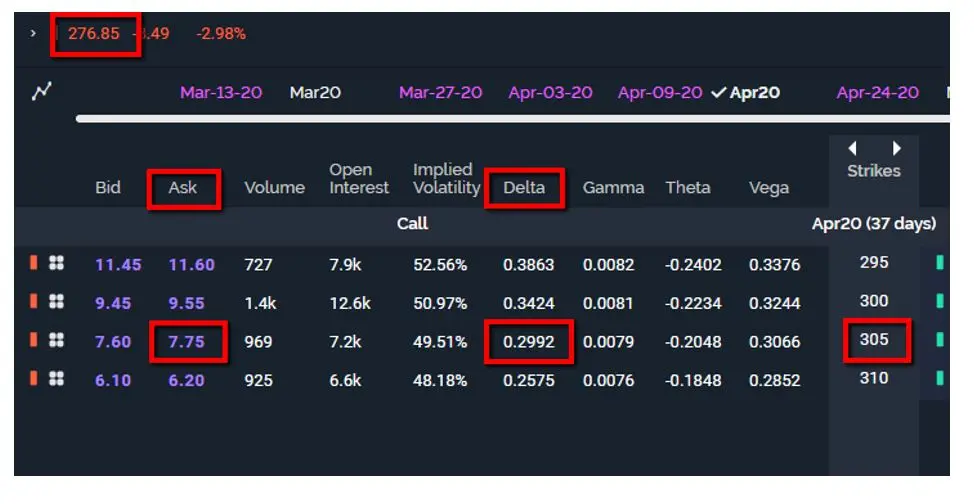

Most trading platforms that provide delta and other Greeks automatically calculate these values using their built-in pricing models, which are often variations of the Black-Scholes model, especially for European options. For American options, which can be exercised at any time before expiration, the calculations are typically done using binomial models or other numerical methods that can handle the possibility of early exercise.

The actual algorithms used can vary between platforms and may be proprietary. Some platforms may allow sophisticated users to choose between different models or to adjust the parameters used in the calculations, such as volatility estimates.

Popular Delta Neutral Trading Strategy

Several strategies can achieve delta neutrality, each with its unique risk profile and potential for profit.

Short Straddle

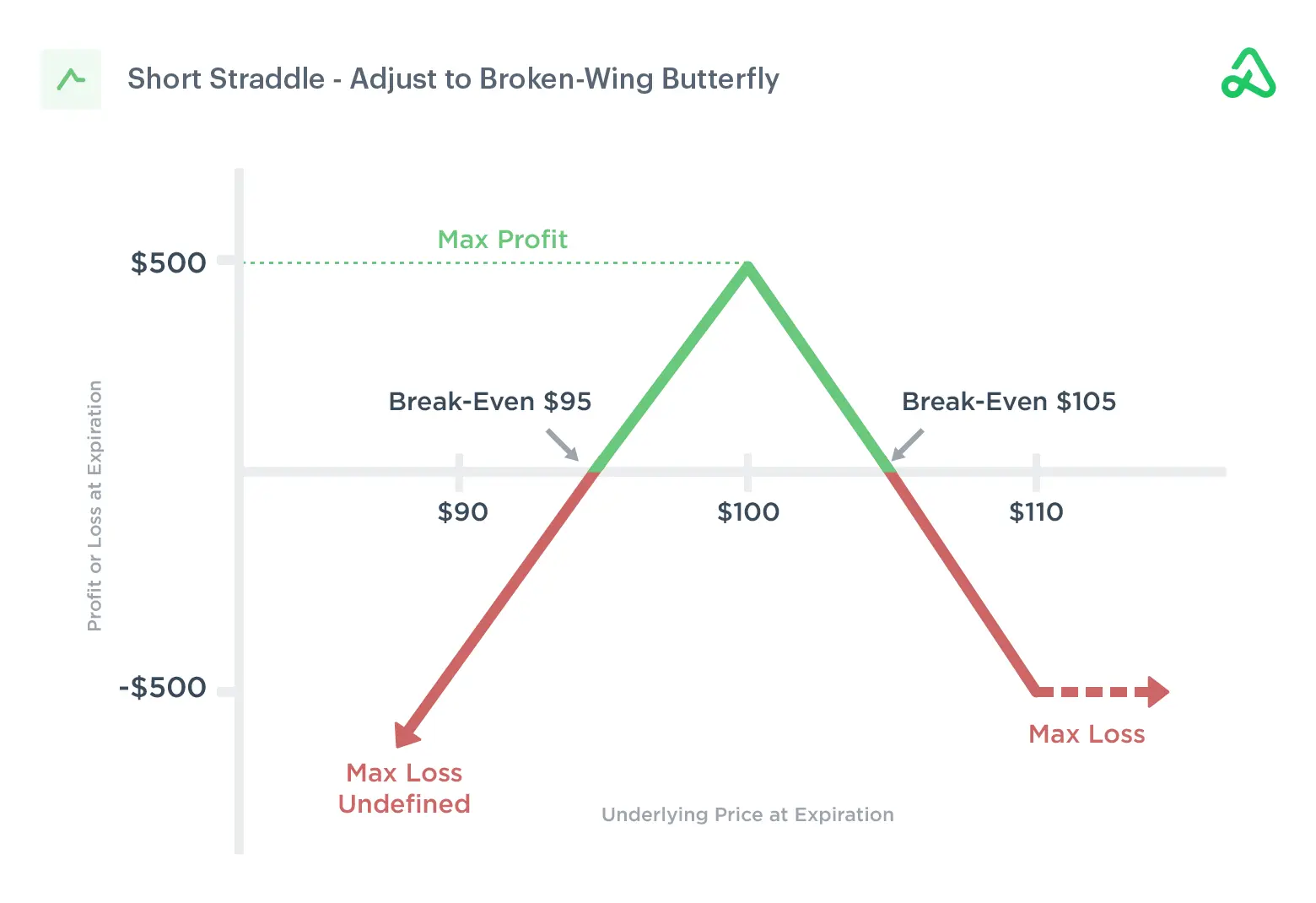

A trader engages in a short straddle by simultaneously writing a call and a put at the same strike price, betting on a stable asset price. While the initial premium is the profit, a significant price shift in the asset could lead to substantial losses.

Short Strangle

Differing from the straddle, a short strangle involves selling higher-strike calls and lower-strike puts, speculating that the asset value will stay within a defined range, limiting the risk to substantial price movements.

Short Iron Condor

In a short iron condor, the trader sells a put and a call while buying another pair of puts and calls with more distant strikes. The trader profits if the asset's price remains within the middle strikes, avoiding the extremes.

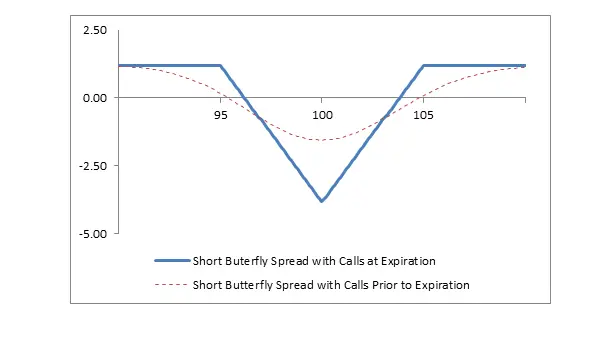

Short Butterfly

A short butterfly spread is crafted by selling at-the-money options paired with buying options both in and out of the money. This strategy is chosen when a trader forecasts a minor deviation in the asset's price from its current level.

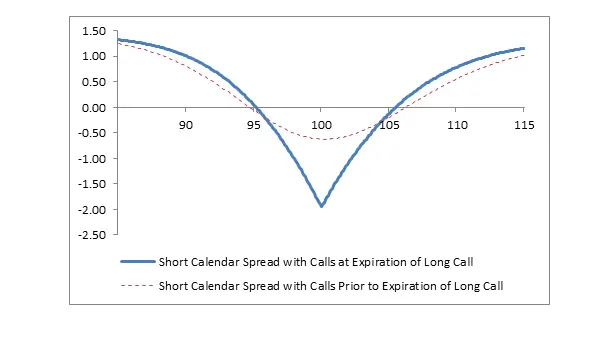

Short Calendar Spread

With a short calendar spread, a trader sells a short-dated contract and buys a longer-dated one at the same strike, aiming to capitalize on the faster erosion of the short-dated option's time value compared to the long-dated one.

Delta Hedging Strategy Steps

Delta neutral hedging is a dynamic process that requires constant monitoring and adjustment to maintain a position with neutral delta.

Identify Asset

The first step in delta hedging is to choose an asset with a robust and liquid options market. Liquidity is vital because it ensures that contracts can be bought and sold with minimal slippage, which is the difference between the expected price of a trade and the price at which the trade is executed. Common assets used for delta hedging include large-cap stocks, index funds, and increasingly, cryptocurrency like Bitcoin, due to their active markets.

Determine Delta Neutral Level

Now, once an asset is selected, how to find out each position’s and the overall portfolio’s deltas? Some brokers provide analytical tools that calculate the Greeks for each position in real time. They will display the delta on their platforms as for individual options as for the portfolio as a whole.

Additionally, there are specialized trading software packages which often include the tools for delta calculation. Examples include Thinkorswim, Interactive Brokers' Trader Workstation (TWS), and others.

If you are proficient in programming, you can also use APIs provided by financial data services to pull in real-time pricing data and calculate delta using custom-built tools or scripts.

Some advanced traders build their own models using spreadsheet software like Microsoft Excel. Using either built-in financial functions or custom formulas, they calculate the delta of their positions.

Construct Portfolio

After determining the delta neutral level, the trader constructs a portfolio that combines positions with an aggregate delta of zero. This process might involve purchasing and selling contracts with different strikes or maturity dates to equilibrate the deltas. For instance, should a portfolio exhibit a positive delta, the trader might invest in puts (which typically have a negative delta) to achieve balance.

Monitor and Adjust

Delta hedging demands ongoing vigilance and fine-tuning. The portfolio's delta will fluctuate with the market price of the base asset, necessitating regular recalibration. To realign the delta to neutral, the trader must engage in the strategic acquisition or divestment of option contracts or the asset. The frequency of these adjustments correlates with the market's volatility.

Pros and Cons of Delta Neutral Positions

Let's sum up the strategy's pros and cons, to help you to decide if it can become the part of your trading routine. The merits of this strategy include:

- It shields investments from minor price dips in the base asset.

- It can exploit asset volatility or option time decay for potential gains.

- It integrates into multifaceted strategies, broadening investment approaches.

However, there are inherent difficulties:

- It demands vigilant oversight and frequent portfolio adjustments.

- Significant price swings can inflict considerable losses.

- Its complexity may deter novice market participants.

What is Delta Neutral Rebalancing?

When a trader establishes a delta neutral position, they are essentially setting up a portfolio where the positive and negative deltas neutralize one another. But it's important to remember that delta is dynamic, shifting with the base asset's price. Hence, a portfolio's state of delta neutrality can lose its equilibrium with market fluctuations.

Preserving a delta neutral condition necessitates diligent portfolio oversight. This ongoing adjustment, known as delta neutral rebalancing, involves:

- Keeping Tabs on Delta Metrics. Vigilance is key for traders who must regularly assess the delta metrics of their options holdings. These metrics are variable and can change with market conditions. They include asset price shifts, volatility, and the erosion of time value.

- Executing Trades to Rebalance. When the sum of the deltas deviates from zero, the trader must take action to rebalance the portfolio. For example, if the overall delta becomes positive, the trader might sell options with a positive delta or purchase onres with a negative delta to counterbalance.

- Frequent Adjustments. The necessity for portfolio adjustment is tied to volatility. In highly volatile markets, this could mean making adjustments daily or even several times within a day.

- Cost Consideration. Each rebalancing action incurs transaction costs and possibly slippage, which can eat into the profitability of the strategy. Efficient rebalancing seeks to minimize these costs while maintaining the desired delta neutral position.

What is Delta Neutral Arbitrage?

Delta neutral arbitrage is a strategy that exploits price differences between options and their base assets. Traders create a delta neutral position—where the option's price movement is offset by the base asset—to profit from the eventual correction of these discrepancies without being affected by the general market movements. This technique requires quick execution and sophisticated trading tools to manage the associated risks effectively.

Final Thoughts

Delta neutral strategies represent a nuanced approach to options trading, offering a method to mitigate risk in a portfolio. For the astute trader, delta neutral strategies offer a means to exploit the nuances of option contracts pricing, volatility, and time decay.

Yet, these strategies also demand a commitment to continuous learning and a readiness to employ advanced trading tools. Whether one is looking to hedge, arbitrate, or simply manage risk, the delta neutral approach provides a framework that, when executed with skill, can enhance the robustness of an investment portfolio.

FAQ

How Do You Make Money With a Delta Neutral Strategy?

Profits from delta neutral strategies typically come from time decay or volatility. As options approach expiration, their time value decreases, potentially allowing traders to buy back sold contracts at a lower price.

What Is a Delta Neutral Strike?

A delta neutral strike refers to the strike price of an option contract that would make the position delta neutral.

Is Iron Condor Delta-Neutral?

An iron condor can be delta-neutral if constructed with the appropriate strike prices and quantities to balance the deltas.

How Do You Hedge Delta-Neutral?

To hedge a delta-neutral position, traders adjust their holdings of options and possibly the base asset to maintain a net delta of zero.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.