Delta Hedging: Comprehensive Guide with Examples

What Is Delta Hedging?

Delta hedging (or delta balancing) is a sophisticated strategy used by traders for risk reduction. This strategy involves adjusting the composition of an investment portfolio to offset the risk linked to the base asset price movement. In a nutshell, the risk is mitigated by including the base asset and its derivative in such a manner that the delta of the portfolio equals zero — referred to as being “delta-neutral”.

This method is especially useful when the base asset's price is highly volatile. A prime example of such an asset is Bitcoin.

Key Takeaways

- The Greek Delta measures the rate at which the price of an option alters relative to the base asset’s price change

- Delta hedging has an instrumental role in mitigating portfolio risk

- The purpose of delta balancing is to make the portfolio “delta-neutral”

- While delta balancing helps greatly in risk mitigation, its key disadvantage is a high cost

Understanding Delta

Delta is part of a group of values known as the “Greeks”, which collectively help traders evaluate risk. Delta in particular is an estimate of the rate at which the option’s price changes given a $1 change in the base asset’s value.

Let’s say a call contract has a delta of 0.5. It means that the contract's price would rise by 50 cents for each $1 gain in the base asset's price. On the other hand, if a put has a delta of -0.5, the derivative's price would grow by 50 cents for each $1 decrease in the base asset's price. Delta essentially quantifies the sensitivity of a derivative's price to changes in the base asset’s value, making it a critical factor in delta hedging.

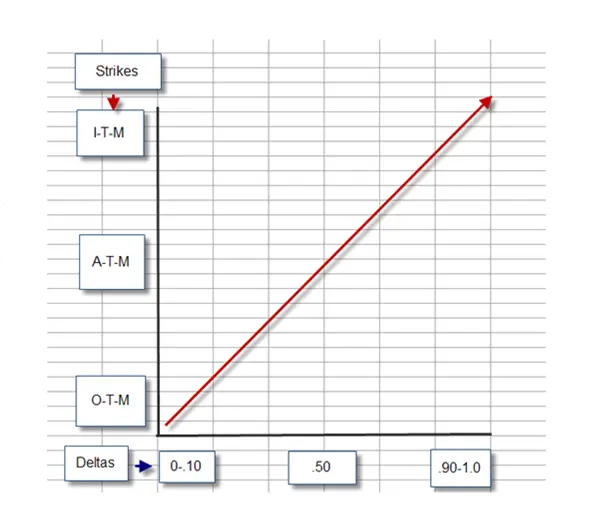

One key aspect of understanding delta lies in its interaction with the status of the option contract in terms of moneyness - whether it is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM).

In-the-Money, At-the-Money, Out-of-the-Money

In the parlance of options trading, options are classified as “in-the-money” (ITM), “out-of-the-money” (OTM), or “at-the-money” (ATM) depending on the relationship between the market price of the base and the option's exercise price (strike). An option falls into the ITM category if it would result in a profit if exercised immediately, whereas an OTM option would lead to a loss. An ATM option sits right at the threshold, with the exercise price equal to the market price of the base asset

For instance, if Bitcoin is currently priced at $20,000, a call with an exercise price of $19,000 would be considered ITM, an option with an exercise price of $20,000 would be ATM, and a contract with an exercise price of $21,000 would be OTM.

The status of the option influences its delta. An ITM call option would have a delta close to +1, indicating a strong likelihood that the option will remain ITM as the price of Bitcoin increases. An ATM option would have a delta close to +0.5, reflecting a roughly even probability of the option ending up either ITM or OTM. Meanwhile, an OTM option would have a delta close to 0, indicating a low likelihood of the option ending up ITM.

How Delta Hedging Works

Now that we understand what delta hedging is and the role that delta plays, let's delve into how it actually works. In its simplest form, delta balancing involves establishing a portfolio in such a way that the overall delta is zero, or delta-neutral. This means that for every long position in the base, there is an equivalent short position in the options, or vice versa.

Let's illustrate this with a delta hedging example. Assume a dealer sells a call option on Bitcoin. The delta of this short call option position is negative, meaning the dealer will lose money if the price of Bitcoin increases. To offset this risk, the dealer could buy some Bitcoins, which have a delta of +1. The dealer would continue to adjust the number of Bitcoins they own, buying more as the price rises and selling some as the price falls, to maintain a delta-neutral position.

Creating the Delta Hedge

Creating a delta hedge requires careful planning and continuous adjustment. Let's say you are a trader who has just sold a call option on Bitcoin. This option has a delta of -0.4, meaning that if Bitcoin's price were to rise by $1, the option's value would increase by $0.4, leading to a potential loss for you.

To protect against this risk, you could buy 0.4 Bitcoin, which, having a delta of +1, would increase in value by $0.4 if Bitcoin's price rose by $1. This would offset the increase in the option's value. However, if Bitcoin's price then changed, you would need to adjust the number of Bitcoins you own to maintain the delta hedge. If the price rose, you would need to buy more Bitcoins; if it fell, you would need to sell some.

Reaching Delta-Neutral

Achieving a delta-neutral position, one where the aggregate delta of all portfolio components — options and the base asset — is nullified, significantly mitigates the risk of price movements. However, this is not a one-off process. Reaching and maintaining a delta-neutral state necessitates constant vigilance and adjustment in response to market changes.

A Brief Primer on Options

Options contracts are financial derivatives offering the holder the right, but not the obligation, to buy or sell an base asset at a predetermined price, referred to as the “strike price”, at or before a specified expiry date. In the context of Bitcoin trading, a market participant might buy a call option if they anticipate an upswing in Bitcoin's price, or purchase a put option if a price drop is expected.

Delta Hedging With Equities

While this article focuses on Bitcoin, it's crucial to acknowledge that delta balancing can be utilized to a wide array of base assets, including equities. In a traditional equity market, traders would create a delta hedge by buying or selling derivatives in line with the number of shares they hold. For instance, if a trader has written call options on a certain stock, they might buy shares of that same stock to hedge their options' exposure. This approach can help to mitigate the risk of adverse price movements.

Delta Hedging Strategies Explained

Given the nuanced and complex nature of trading, there exist various ways to implement a delta balancing strategy. The choice of method primarily hinges on the trader's unique circumstances and market predictions.

When is it Useful?

Delta hedging shines in environments marked by high market volatility. In the context of Bitcoin, an asset renowned for its price volatility, delta balancing serves as a stabilizer, providing a cushion against minor price fluctuations. For traders who desire to limit their exposure to sudden price movements without completely exiting the market, delta hedging could be a viable strategy.

How do you Profit?

As stated before, if the implied volatility (IV) of an option is higher than the trader's forecasted volatility, they could sell the option, creating a short position. This short position would then be delta hedged by buying the vase asset — for instance, Bitcoin. If the trader's forecast is correct, and the actual volatility turns out to be lower than the IV, the contract's price would decrease. This would allow the trader to buy back the option at a lower price, thus making a profit.

However, it's essential to understand that this strategy demands continuous portfolio adjustment and keen awareness of market conditions, which in turn might lead to transaction costs and require significant time and expertise.

Advantages and Disadvantages of Delta Hedging

Like any financial strategy, delta balancing is not without its strengths and weaknesses.

Advantages

- Risk Mitigation. Its foremost strength lies in risk reduction. By creating a delta-neutral portfolio, a trader shields themselves from the adverse effects of price fluctuations of the base asset.

- Flexibility. Delta hedging, by nature, is highly adaptable. This strategy responds to market dynamics and allows for swift adjustments to be made in reaction to market shifts.

Disadvantages

- Cost. A key downside to delta balancing is its cost. The need for regular portfolio adjustments leads to increased transaction costs, which can eat into potential profits.

- Complexity. Delta balancing requires a solid understanding of options and their Greeks. This complexity can be daunting for those new to options trading, and managing a delta hedge effectively requires careful attention to detail and timely decision-making.

Practical Examples of Delta Hedging

To shed light on how to hedge options with delta in practice, let's consider two examples centered around Bitcoin as the base.

Trade Example #1: Hedging Long Stock With Long Puts

Let's now illustrate a practical example of how a delta balancing strategy might be implemented. Imagine that you, as an investor, are in possession of a substantial quantity of Bitcoin, let's say 100 units, that you purchased at a rate of $20,000 each. Now, while you're optimistic about the long-term prospects of Bitcoin, you're concerned about the potential of a short-term decline in price.

To protect yourself from the immediate risk, you could implement a delta hedge strategy by purchasing put options. Assume you decide to purchase at-the-money (ATM) put options, each carrying a delta of -0.5, on Bitcoin. Since each put's delta is -0.5, you would buy two put options for each Bitcoin you own, creating a delta-neutral position. In this way, if Bitcoin's price drops, the value of your long put options would increase, offsetting the loss on your Bitcoin holdings.

Trade Example #2: Hedging Short Stock With Long Calls

Conversely, let's suppose you've short-sold 100 Bitcoins, predicting a near-term fall in Bitcoin's price. However, if Bitcoin's price starts rising, you could face significant losses. To counteract this risk, you could employ a delta hedge by buying call options on Bitcoin.

If you decide to buy ATM call options, each with a delta of +0.5, you would need to buy two call options for each Bitcoin you have shorted to establish a delta-neutral position. Thus, if Bitcoin's price increases, the gain from your long call options would offset the loss on your short Bitcoin position.

In both examples, you need to continuously adjust the number of options you own in response to changes in Bitcoin's price to maintain your delta-neutral position, which can be a demanding but potentially rewarding process.

Advanced Concepts in Delta Hedging

As one delves deeper into the realm of delta balancing, several complex concepts emerge.

Can You Use Delta to Determine How to Hedge Options?

Indeed, the delta plays a pivotal role in devising a hedging strategy. It serves as a gauge of how many options are needed to hedge a position in the base asset effectively. By monitoring the delta of an option, a trader can continually adjust their balancing strategy to keep their portfolio delta-neutral.

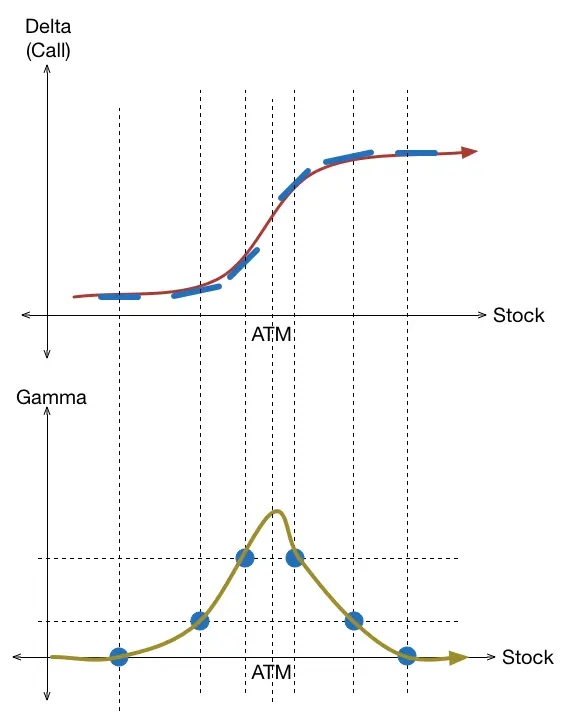

What Is Delta-Gamma Hedging?

The concept of delta-gamma hedging is an extension of the standard delta hedging strategy. This advanced method considers not only the delta, but also the gamma of a derivatives' portfolio. Gamma, another of the options Greeks, measures the rate of change of delta for a $1 move in the price of the base. By incorporating gamma into their balancing strategy, traders can better mitigate risk for larger price moves.

The Bottom Line

In summary, delta hedging is a dynamic strategy that can be an effective tool for risk mitigation in options trading, particularly in highly volatile markets like Bitcoin. By employing this approach, traders can strive for a delta-neutral position that provides protection against minor price fluctuations. However, implementing a successful delta balancing strategy requires a solid understanding of options and their associated Greeks, alongside diligent monitoring and management of one's portfolio.

FAQ

Can Delta Hedging Be Used With Bitcoin and Other Cryptocurrencies?

Absolutely. The principles of delta hedging apply to any market with tradable options, including Bitcoin and other cryptocurrencies. Given the typically high volatility of these digital assets, delta balancing can be particularly useful in these markets.

How Does Delta Hedging Help in Trading Bitcoin Options?

Delta hedging in Bitcoin derivative trading helps to mitigate risk associated with Bitcoin's price volatility. By creating a delta-neutral portfolio, a market participant can protect themselves from minor price changes, giving them more stability in an otherwise highly volatile market.

Can Delta Hedging Protect Against the Risk of a Major Downturn in the Cryptocurrency Market?

While delta balancing can protect against minor price fluctuations, it's not foolproof against major market downturns. It's worth noting that the delta of an option alters with the price of the base asset, so a significant price change could necessitate substantial adjustments to maintain a delta-neutral position.

What Are the Key Factors to Consider When Implementing a Delta Hedging Strategy?

Among the main factors are market volatility, transaction costs, understanding of options, and time commitment.

What Is Delta Neutral Hedging

Delta neutral hedging entails the careful construction of a portfolio using options and/or bases, arranged in such a way that the portfolio's accumulation of negative deltas is counterbalanced by an equivalent quantity of positive deltas from other components.

This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.