Deep Out of the Money Options Strategy

As traders navigate the vast sea of investment opportunities, the deep out of the money (DOTM) strategy offers a unique blend of risk and reward. Originally used in traditional trading practices, it is successful applied in cryptocurrency trading as well.

Key Takeaways

- Deep out of the money options (DOTM) are options with strike prices significantly distant from the current market price.

- DOTM options are a cornerstone of high-risk, high-reward strategies.

- The crypto world, especially Bitcoin, has added layers of complexity to DOTM options trading.

What are Deep Out of the Money Options (DOTM)?

Deep out of the money options, often termed as DOTM options, possess strike prices that diverge greatly from the prevailing market price. These options, while appearing to be a gamble, are a calculated risk for many traders. Their attraction lies in their affordability and the perspective of significant returns. Yet, they come with inherent risks, given their low probability of ending in the money.

With the emergence of the new market of digital assets, which is highly volatile, the dynamics of buying deep out of the money options have changed. This necessitates traders to constantly update their knowledge and strategies, ensuring they are aligned with market movements.

Understanding Deep Out of the Money

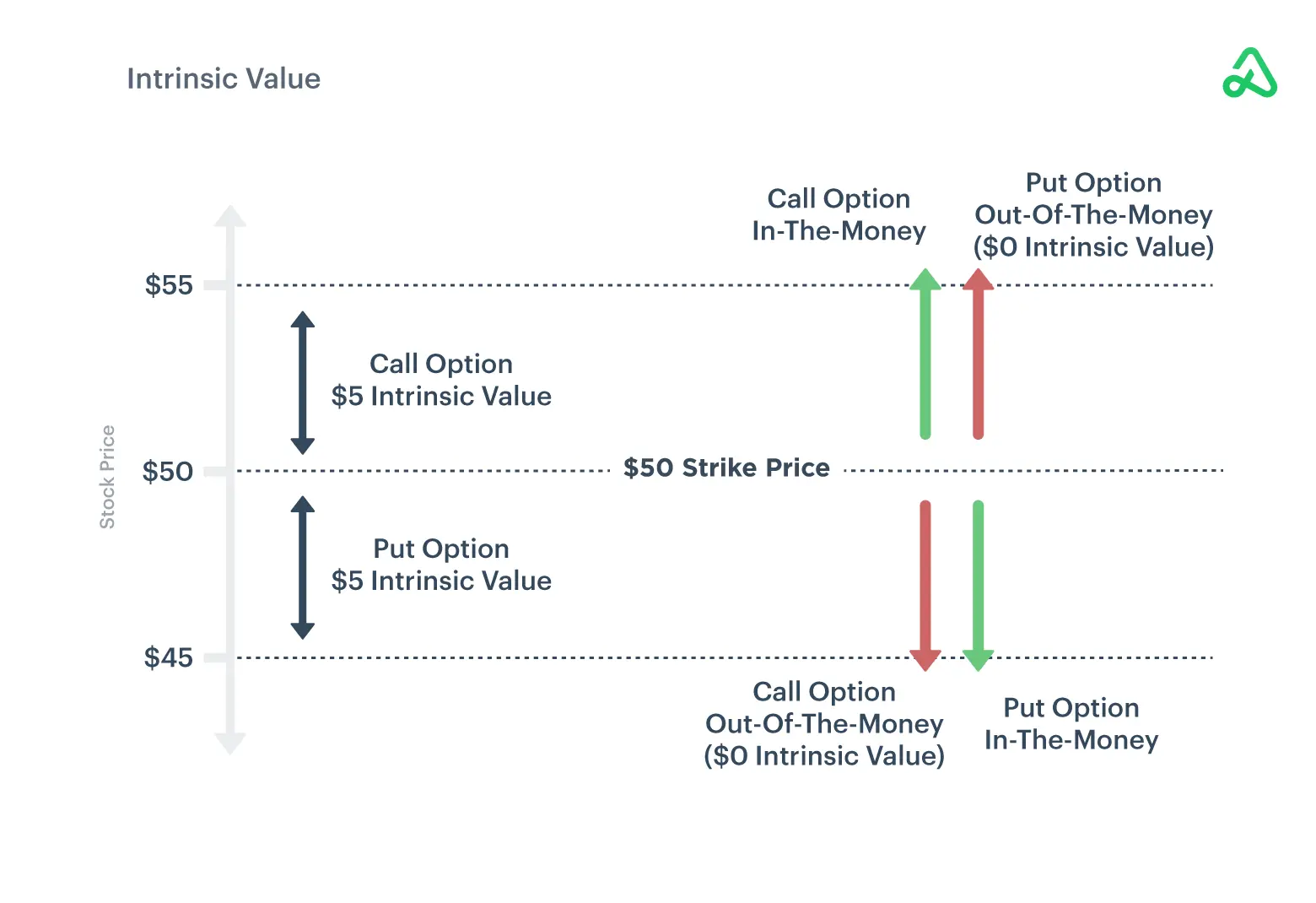

As it was mentioned above, deep out of the money (DOTM) options have strike prices at a significant distance from the current market price of the underlying asset.

The strike price for call options is well above the current asset value. Conversely, for put options, it is well below the value of the base asset. For instance, if an asset costs $50, a call with a strike price of $70 or a put with a strike price of $30 is considered DOTM.

To truly grasp the essence and intricacies of DOTM options, one must delve into their characteristics, potential benefits, and associated risks.

Characteristics of DOTM Options

- High risk-reward ratio: DOTM options offer a high risk-reward profile. That is, with the low initial investment (the premium) there is a potential for high returns if the market moves favorably. However, the probability of these options expiring in the money is relatively low, making them a speculative play.

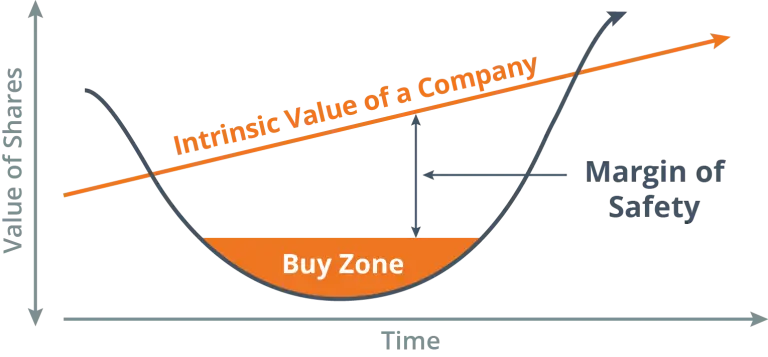

- Primarily time value: The value of DOTM options is almost entirely extrinsic, meaning it's based on time value rather than intrinsic value. As the option approaches its expiration date, time decay can erode this value rapidly.

- Low premiums: Since these options are far from being in the money, they are typically available at a fraction of the price of at-the-money or in-the-money options.

Potential Benefits

The DOTM options' unique features offer certain advantages for traders.

- Cost efficiency: As previously mentioned, OTM options typically have lower premiums than their ITM counterparts. This affordability allows traders to diversify their option strategies, purchase multiple contracts, or maintain liquidity for other opportunities.

- Portfolio protection: For those holding a diversified portfolio, buying buying deep out of the money put options can act as an insurance mechanism. These options provide a right to sell assets at a predetermined price, serving as a hedge against unforeseen market downturns. The relatively low cost of OTM puts compared to ITM puts makes them a cost-effective hedging tool.

- Strategic flexibility: OTM options can be employed in various complex trading strategies, like credit spreads. These strategies can benefit from the decay of time value in OTM options, allowing sellers to potentially keep the premium without the options being exercised.

- Defined risk: When purchasing an OTM option, the maximum risk is limited to the initial premium paid. This clear risk parameter allows traders to make informed decisions about the potential downside of a trade.

Associated Risks

At the same time, one should bear in mind the risks associated with the DOTM options:

- High probability of expiring worthless: Given their distance from the current market price, DOTM options have a high likelihood of expiring worthless. Traders must be prepared for the potential loss of the entire premium paid.

- Market volatility: The value of DOTM options can be highly sensitive to market volatility. While increased volatility can enhance the value of these options, it can also lead to rapid losses. Also, with assets like Bitcoin and other cryptocurrencies known for their volatility, the dynamics of buying and selling deep out of the money options in the crypto realm can differ significantly from traditional markets. Therefore, traders need to be even more cautious with OTM options on cryptocurrency.

Example

Let's delve into a practical example to better understand the dynamics of deep out of the Money (DOTM) options. We will take Bitcoin as a base asset.

Imagine, Bitcoin is currently trading at $50,000. A trader believes that due to upcoming regulatory changes, there's a possibility, albeit small, that Bitcoin might experience a sharp decline in the next three months. To capitalize on this potential movement without directly shorting Bitcoin, the trader considers buying a DOTM put option.

The trader identifies a put option with a strike price of $30,000, expiring in three months. This option is considered deep out of the money because the strike price is significantly below the current market price. The premium (cost) for this option is $500.

Possible Outcomes:

- Favorable market movement: Suppose regulatory news emerges that is unfavorable for Bitcoin, causing its price to plummet to $25,000. The trader's DOTM option is now in the money. The intrinsic value of the option is $5,000 ($30,000 strike price – $25,000 current price). Minus the initial premium of $500, the trader realizes a profit of $4,500.

- Unfavorable market movement: On the other hand, if Bitcoin's price remains above $30,000 or doesn't fall significantly, the option will expire worthless. The trader's loss is limited to the premium paid, which is $500.

- Break-even point: For the trader to break even, Bitcoin's price would need to drop to $29,500 by the expiration date ($30,000 strike price – $500 premium).

This example illustrates the high risk-reward nature of DOTM options. The trader risked $500 with the potential to make a substantial profit if their market prediction came true. However, the probability of the option expiring worthless was also high, given the significant gap between the strike price and the market price at the time of purchase. Such speculative plays require a keen understanding of market dynamics, especially when dealing with volatile assets like cryptocurrencies.

Trading Strategy

The deep out of the money options strategy is multifaceted, demanding a blend of research, intuition, and strategy. It's not just about selecting an option and hoping for the best. It requires a deep understanding of market dynamics, technical indicators, and global events.

Identifying Deep Value Stocks

Deep value investing is a strategy that seeks to identify and invest in stocks that are trading at a significant discount to their intrinsic value. These stocks are often overlooked, misunderstood, or out of favor with the broader market, presenting potential opportunities for astute investors.

Identifying deep value stocks requires a combination of quantitative analysis, qualitative assessment, and a contrarian mindset. Here's a detailed exploration of the process:

1. Financial statement analysis

- Look for companies with a strong balance sheet, characterized by low debt, high current ratios (indicating liquidity), and substantial tangible assets relative to liabilities.

- Review the chosen companies’ income statements and pick the ones with consistent earnings, even if they're modest. A history of profitability can indicate a resilient business model.

- A company generating positive free cash flow is often a good sign. It indicates the company can sustain its operations and invest in its future without relying on external financing.

2. Valuation Metrics

- A low price-to-earnings (P/E) ratio compared to industry peers or the stock's historical average might indicate undervaluation.

- Deep value stocks often trade at a Price-to-Book (P/B) ratio significantly below 1, suggesting the market price is less than the company's book value.

- A higher-than-average dividend yield can be a sign of undervaluation, provided the company has a history of stable dividend payments.

3. Qualitative Factors

- A competent, transparent, and shareholder-friendly management team can be a strong indicator of a company's potential to overcome challenges and realize its intrinsic value.

- Even if a company is currently facing headwinds, a durable competitive advantage or “moat” can ensure its long-term viability and profitability.

- It's essential to understand the broader industry trends. Even a great company in a declining industry might struggle to realize its value.

4. External Factors and Catalysts

- Sometimes, broader economic conditions can depress an entire sector or market, providing opportunities to pick quality stocks at discounted prices.

- Identifying potential future catalysts, such as regulatory changes, technological advancements, or mergers and acquisitions, can provide insights into how and when the stock might realize its true value.

In the context of digital assets like cryptocurrencies, traditional deep value investing principles can still apply. For instance, during market downturns, certain crypto assets might trade at significant discounts to their perceived intrinsic value, presenting potential deep value opportunities. However, the inherent volatility and unique dynamics of the crypto market necessitate additional caution and due diligence.

Choosing the Option Contract to Trade

Selecting the right option contract can significantly influence the potential profitability of a trade and the associated risk. Given the myriad of available options, traders must consider several factors to make an informed choice. Here's a comprehensive breakdown of the process:

1. Define Your Objective

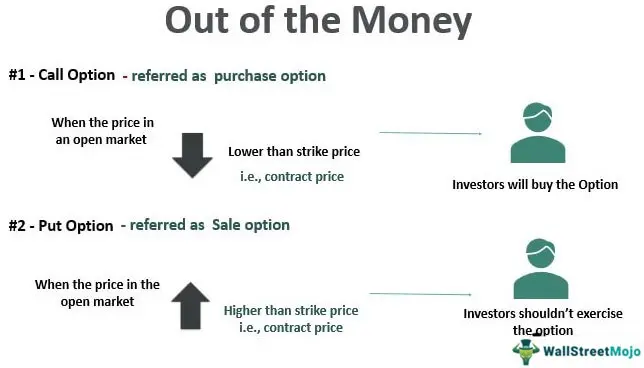

- Speculation: Traders speculating on price movements anticipate future market directions. Depending on their analysis, they might opt for call options, expecting a rise in the asset's price, or put options, predicting a decline. This approach is inherently riskier, but can yield substantial returns if the market moves in the anticipated direction.

- Hedging: Hedging is a risk management strategy. Investors use options to offset potential losses in other investments. For instance, an investor holding stocks might buy put options to protect against a potential drop in the stock's value. Conversely, those short on stocks might buy call options as a hedge against potential price increases.

2. Consider the Underlying Asset

- Volatility: An asset's price fluctuations over time define its volatility. Highly volatile assets can lead to larger option premiums due to the increased risk of significant price swings. While this means higher costs, it also presents opportunities for greater returns, especially for traders with a high risk tolerance.

- Liquidity: A liquid market has many active buyers and sellers, ensuring smooth transactions. Options on liquid assets typically have narrower bid-ask spreads, reducing transaction costs. It also means traders can enter or exit positions without significantly affecting the asset's price.

3. Expiration Date

- Short-term vs. long-term: The expiration date determines the option's lifespan. Short-term options, often expiring within weeks, cater to traders anticipating swift market movements. Long-term options, lasting several months to years, are suitable for those expecting slower, more prolonged market shifts.

- Time decay: As options approach their expiration date, their time value diminishes. This phenomenon, known as time decay or theta, accelerates as expiration nears, impacting the option's premium.

4. Strike Price

- In-the-money (ITM): ITM options have intrinsic value, meaning there's already a benefit to exercising the option. They command higher premiums due to their greater likelihood of yielding a profit at expiration.

- At-the-money (ATM): ATM options have their strike price very close to the asset's current market price. They strike a balance between cost and potential return, making them popular choices for many traders.

- Out-of-the-money (OTM): OTM options currently have no intrinsic value. They're more affordable but require a significant price move in the trader's favor to become profitable. They're riskier but can offer substantial returns on significant market shifts.

5. Implied Volatility (IV)

- High IV: A high IV suggests the market expects significant price fluctuations. This anticipation can stem from upcoming events or general market uncertainty, leading to pricier options.

- Low IV: A low IV indicates the market expects minimal price movement. These options are less costly and might be favored in strategies benefiting from declining volatility, like credit spreads.

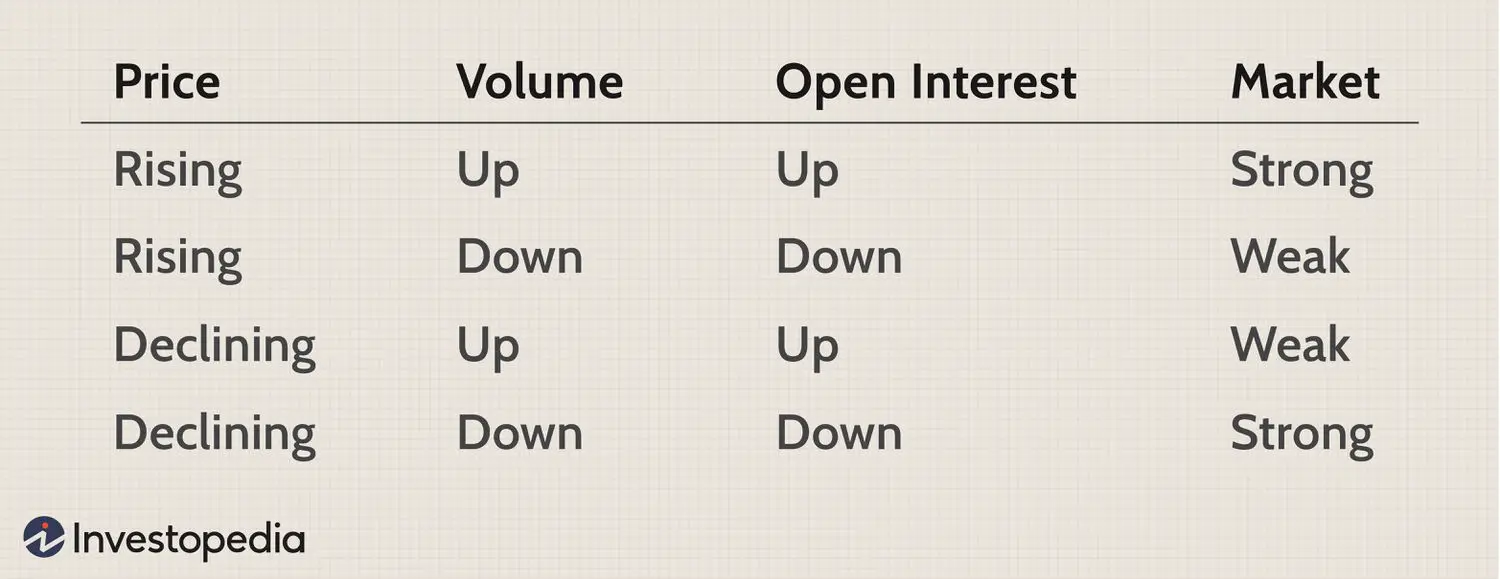

6. Open Interest and Volume

Open interest represents the total number of outstanding option contracts, while volume indicates the number of contracts traded in a day.

High figures in both metrics suggest the option is popular and actively traded, ensuring tighter bid-ask spreads and efficient trade execution.

7. External Factors

- Upcoming events: Market-moving events, such as earnings announcements or macroeconomic data releases, can introduce volatility. Being aware of these events is crucial as they can significantly impact an option's price.

- Dividends: Stocks paying dividends can influence associated option prices. If the ex-dividend date (the deadline to own the stock and receive the dividend) is close to the option's expiration, it can affect the option's premium and potential exercise decisions.

Understanding the Payoff of the Strategy

DOTM options are a double-edged sword, offering the potential for significant returns but at a high risk. Grasping the potential payoff and inherent risks is vital. Especially with the crypto market's added volatility, this understanding becomes even more crucial. Traders must be prepared for rapid market movements, especially in the world of cryptocurrencies, and have strategies in place to mitigate potential losses.

DOM vs. OTM

Both terms, DOM (or DOMT) and OTM, describe options that currently lack intrinsic value. However, they differ in the extent to which the option's strike price is away from the current market price of the underlying asset.

DOTM options have a strike price that's significantly distant from the current market price of the underlying asset. It makes them more speculative and typically more affordable.

On the other hand, OTM options, while also lacking intrinsic value, have a strike price closer to the market price than a DOTM option. Thus, they offer a middle ground in terms of risk and reward.

Recognizing these subtleties allows traders to align their strategies more effectively with their market outlook and risk tolerance.

Conclusion

The deep out of the money options strategy is a journey fraught with risks and rewards. In a world where crypto assets like Bitcoin are reshaping financial paradigms, traders must be agile, informed, and strategic. With thorough research and a clear strategy, this approach can offer lucrative returns. However, it's essential to be prepared for the inherent risks, especially in the volatile world of cryptocurrencies.

FAQ

How Do You Trade Deep Out of Money Options?

Trading DOTM options requires a blend of research, strategy, and market insights. With the rise of crypto assets, understanding their impact on traditional markets is vital.

Why Do People Sell Deep in the Money Options?

Traders sell these options primarily to collect premiums, banking on the likelihood of these options expiring worthless. However, the volatile nature of markets, especially in the crypto realm, adds layers of complexity.

Is Selling Deep in the Money Puts Bullish?

Indeed, selling deep in the money puts is a bullish strategy, indicating an expectation that the asset's price will remain above the strike price.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.