Trading 101: Cryptocurrency Day Trading Guide and Strategies for Beginners

Risk management is a skill that successful investors have mastered. They understand that in order to be successful, you must have a winning strategy and the right mindset. A lot of individuals and corporate firms make money every day by trading cryptos. However, success in cryptocurrency trading (especially for beginners), like anything else in life, requires hard work, education, and patience.

It's imperative to understand the basics of the market before you begin trading. This article will explain everything you need to know about day trading cryptos. So, let's get started.

How Does Day Trading Crypto Work?

Day trading refers to buying and selling digital assets within the same day to profit from short-term price swings. Because crypto prices can be highly volatile, day traders might profit from low prices and high price swings. However, traders can also incur significant losses if the market moves against them.

Day trades only feature positions that are opened and closed the same day. Some trades might be held for only a couple of hours, some minutes, and even seconds. For example, John could buy 35BTC at $40k each and resell them within 5hrs at $42k each, provided that market moved his way.

Day trading cryptocurrency is also about riding the wave of volatility; day traders profit from cryptocurrencies' rapid price swings. On most trading days, day traders control a significant amount of liquidity in the markets since they use large amounts of money, bolstered by leverage, to make a profit.

It is reasonable to say how to day trade cryptocurrencies starts with Bitcoin. Since BTC is often considered the top crypto to buy, and because of its market dominance, how to day trade Bitcoin should be high on the list for every beginner.

Day Trading in Crypto vs Stocks

Over the years, technology has taken asset trading to the next level. Asset trading started with physical locations but has now upgraded to digital brokers. With decentralized exchanges and peer-to-peer technology, crypto has taken things to the next level.

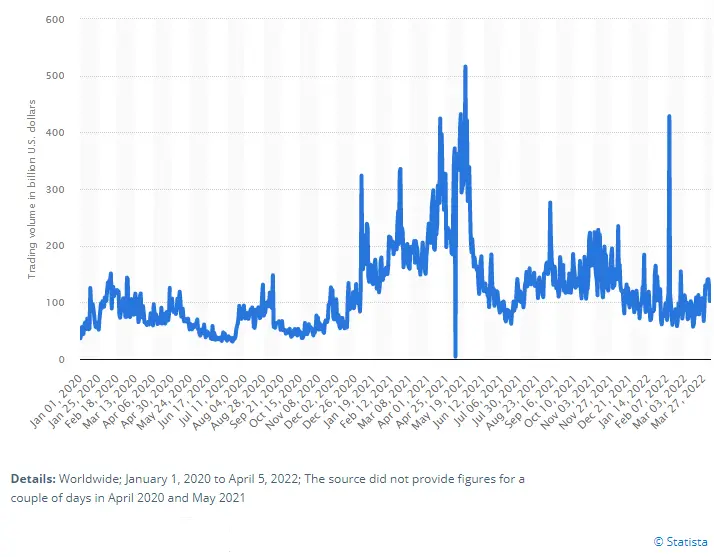

We now have several digital exchanges that record billions of dollars in trade volume and offer the convenience of trading from anywhere in the world without a physical location.

The timing of trades is one major difference between day trading in the stock markets and cryptocurrencies. Stock markets have opening and closing periods during which all trading activities occur. Crypto markets are open all day long.

Overall cryptocurrency 24hrs trade volume from January 1, 2020, to April 5, 2022 (in billion U.S. dollars)

Stocks trading differs from trading crypto in terms of the underlying. If you trade stocks, you do it so you ‘own’ a piece of the company or make quick profits by trading a piece of news, earning calls, and other market sentiments. In the contrary, owning crypto typically doesn’t mean the investor owns part of the firm (except for security tokens), instead it provides access to certain platform that comes with different sets of advantages, depending on the project.

Day trading in crypto also widely differs from day trading in the stock market because of the ‘volatile’ nature of the price of Bitcoin and other crypto-assets. Since most crypto assets respond to that of Bitcoin, every trader needs to know how to day trade Bitcoin.

Strategies: How to Day Trade Cryptocurrencies

The day trader looks out to catch trends and reversals within a short time frame for little profit or much-leveraged profits. While it might seem like many risks are involved in day trading, a trader needs to be patient enough to watch his strategy play out. So, here are the best day trading strategies for beginners.

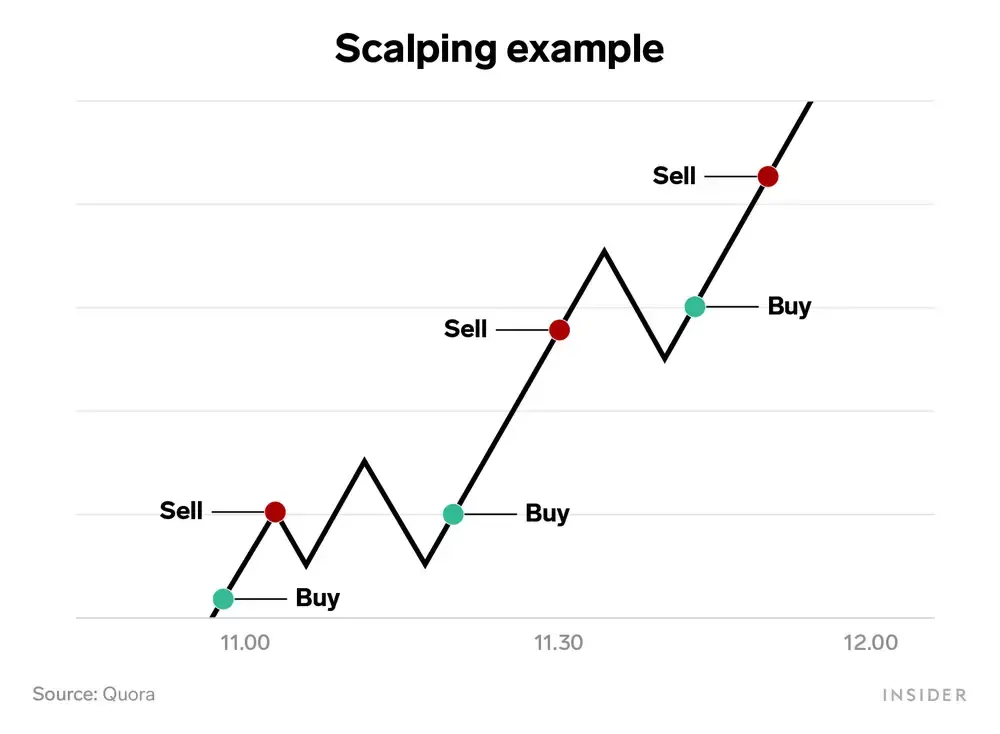

Scalping

Day trading crypto cannot be complete without addressing scalping. It is using large amounts of money to make small profits repeatedly within a short time. The profits are usually small relative to the invested amount, but the trick is to repeat this process many times a day with the same or different pairs and increase leverage when sure about a move. Scalpers often favor turnover rates over individual profits, i.e., they believe in the slow and steady accumulation of profits.

However, this might not be the best day trading strategy for beginners, as only proven strategies can repeatedly identify profit avenues. If a scalper is to make eight successful trades, he needs to find at least 12 different opportunities within 24hrs because the market won’t always go in his direction.

News Trading

This is one of the good day trading strategies for beginners. It only requires a basic understanding of how market psychology affects demand and supply to make profits. Whenever the news of an event or an improved feature or defect of cryptocurrencies or related assets becomes public, price action is predictable.

The simple idea of this strategy is that whenever a development that could increase peoples’ confidence (and investment) becomes public, the asset's price will appreciate, and vice versa. This day trading strategy for beginners relies majorly on fundamental economic principles, not price charts. Also, it is among the best trading strategies for beginners.

Range Trading

This is another rudimentary day trading strategy for beginners. It refers to day trading Bitcoin or any cryptocurrency within a price range. It is used when the price moves around an orbit (fair value zone). Often, the price can be divided into support, resistance, and fair value areas.

When the price keeps going back and forth within this area, the strategy requires one to buy when the price falls to a support zone because it is expected that the price will be supported back up (to rising) by bulls in that zone. Similarly, selling pressure drives the price down when the price reaches a resistance level.

This day trading strategy for beginners is easier than scalping because it only requires identifying support and resistant levels in a ranging price movement.

Arbitrage Trading

This strategy involves capitalizing on price discrepancies on exchanges. Imagine Redot currently lists the LTC/USDT pair at $97.5 while Huobi trades theirs at $97.1. If one purchases 100LTC coins from Huobi, it will cost $9710. This can be sold to Redot for $9750, at a profit of $40 (excluding fees). If this is done ten times in a day, a profit of $400 would have been made.

This strategy is a favorite when day trading Bitcoin. However, these transactions must be completed swiftly since the pricing mechanism will fix the price as soon as other arbitrageurs exploit this gap or the demand and supply forces on that exchange regulate the price. Humans can not achieve this level of speed and accuracy, leading us to the next section.

How to Use Technology in Day Trading

Trading technologies are important tools that help inform the decisions of both beginners and experienced traders. These techniques can help spot trends, automate processes, pick trades, etc. Let's look at two essentials in day trading crypto.

Price Chart Softwares

Charts are essentially one of the most overlooked trading technology. However, charts are also one of the most useful inventions for traders. Imagine how the world was when you had to base your financial decisions entirely on the advice of brokers and brokerage houses. Day trading back then was impossible; the lack of publicly accessible charts led to so many people buying ‘dead’ assets and the rise of several fraudulent brokerage firms.

Because of the invention of price charts, indicators, many metrics, and strategies were developed to be used in day trading markets, including crypto. For example, day trading crypto such as Bitcoin requires you to check the BTC price chart for trends and patterns using several indicators.

Trading Bots

Trading bots are wonderful pieces of tech that could help traders automate processes based on pre-defined instructions. All day trading strategies for beginners can be improved with these bots because they increase precision in entries. They also aid consistency by helping with pre-set trade schedules, like in range trading. Some trading strategies for beginners are most profitable when facilitated by bots like arbitrage trading.

Crypto Day Trading: Pros and Cons

Day trading crypto requires more precision and precise judgment calls. Traders should select a few pairs from the best cryptocurrencies to trade. Here are some pros and cons of crypto day trading.

Pros

Huge Profit Potential

This may seem ironic considering that day traders only make small returns in batch. But when looking at the larger picture, these little profits could add up to substantial amounts. Using leverage can be a useful tool for day traders. When employed strategically, it can amplify returns on trades.

For instance, when day trading Bitcoin on Redot with a 1:10 leverage, a 10% price change in your favor could double the capital. And according to price tables, several assets record a 24hr change of at least a 10% increase or decrease daily. This means, between 00:00 (GMT) - 23:59 (GMT), every day, many cryptos record at least +10% or -10% change in price.

Constant Profit

This is the ingenuity of day trading: while swing traders and investors have to wait for days or even months before they can make a profit, crypto day trading offers people the chance to make profits every day. It isn’t uncommon to see people boast of making $100 - $1000/day. These people are day traders. Although, profitability still lies in picking the best coins to day trade.

Lesser Emotional Rollercoasters

Day trading crypto saves day traders the stress, concern, and potential "heartbreak" most investors face. When a day trader is through for the day, he sells all of his assets and converts them to stable currencies. If there is a market crash or a change in the fundamentals of an asset, an investor that had taken a very long position on an asset would become unsettled. These and others are emotional issues a day trader doesn’t have to deal with.

Cons

High Risk To Reward Ratio

This means that the amount of money put at stake to make profitable intra-day trades is much higher and disproportionate to the profit. The amount of risk-reward ratio should be considered before taking any trade.

Over-Leverage

Leverage boosts the outcome of trades, either positive or negative, but over-leveraging kills capital. For example, if a trader is day trading Bitcoin at a leverage rate of 1:10, and Bitcoin moves 10% away from the trader’s position, all the capital at that point will be lost.

Crypto Day Trading Tips for Beginners

Cryptocurrency trading for beginners should start with picking and refining a strategy that works for you. Whatever technique you choose to profit from day trading cryptocurrencies, there are a few basic guidelines to follow:

Follow the Leader (BTC)

An important tip to note in cryptocurrency trading for beginners is the role Bitcoin plays; the prices of other cryptocurrencies (altcoins) respond to the price movement of BTC. Until recently, Bitcoin had more than half of the entire crypto market capitalization. It brings this overbearing influence to play whenever any major event (a fundamental change, a whale’s action, etc.). Thus, it is vital to monitor Bitcoin price movements, regardless of the crypto you are trading.

Get Knowledge

Cryptocurrency trading for beginners can only be successful if there is a continuous pursuit of knowledge. A good grasp of technical analysis (TA); charts, candlestick patterns, indicators, fundamental analysis, and sentimental analysis. Knowing the core why and how of the market makes you a profitable trader in the long run.

Gain Experience

You need formidable experience to succeed as a day trader. The best way to gain experience is by understanding what works and what doesn’t. The experience takes time; don’t beat yourself up when you make a mistake. You won’t become a pro trader overnight; mastery takes time. And if you are a newbie, demo accounts make cryptocurrency trading easier for beginners, and allow you to get comfortable with actual market situations without committing capital. This experience would help you control your emotions, spot opportunities, and learn without stress.

In Conclusion

Day trading is a powerful skill when mastered. But before sticking with day trading, consider other forms of cryptocurrency trading for beginners to find which best suits your needs.

If you eventually decide to stay with day trading, ensure to get the knowledge first. The last point to re-emphasize is that knowing how to day trade cryptocurrencies starts with knowing how to day trade Bitcoin.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.