What is Scalping in Crypto: Trading Strategies for Beginners

Crypto Scalping and How It Works

The high volatility of digital assets makes them an attractive instrument for short-term trading. Traders use a special strategy for small and quick profits, called “scalping”.

Scalping is one of the most popular trading methods that proved its efficiency long time ago. It has long been actively used for making profits in the classic markets. With the growth of the cryptocurrency industry, scalping began to be applied in crypto trading, too.

This strategy first became widespread in the 20th century. Back then, exchanges started to actively develop and utilize computer technology. Gradually, with computers becoming more powerful, traders could faster open and close positions.

As practice has shown, scalping is more suitable for professionals who have built their own complex trading systems. Now let’s take a closer look at the peculiarities of this trading strategy.

What Is Scalp Trading in Crypto?

Scalping is a short-term holding of a position, with closing the trade as soon as the minimum profit is made. The duration of such transactions ranges from several minutes to seconds. Being a high-speed trading strategy, scalping requires opening and closing transactions with high frequency.

The comparison between scalping and the work of a surgeon who carefully uses a scalpel suggests itself. Traders who use this strategy are called “scalpers”. In spite of the fact that a scalper makes a moderate profit from one order, the dozens of deals made in one day may bring quite notable earnings. Especially, if the initial capital is rather large.

To manage their trading activity, scalpers mainly rely on technical analysis .They typically make advantage of short-term volatility bursts rather than large price movements. At the same time, scalping can hardly be called a universal strategy. It requires deep understanding of the market mechanics and fast decision-making skills (often under stress).

The popularity of this strategy in the cryptocurrency market is directly related to the volatility of digital assets. Because the higher the volatility of the asset, the more scalpers can earn. Even though scalping Bitcoin is quite popular, scalping works best on altcoins. Their price can change up to 20% per day and up to 1% per hour.

How Does a Scalping Strategy Work?

Now that we have a general idea of scalping, we will tell you more about the main components of the strategy. Closing Opposition

Short Timing and Quick Decisions

From all short-term strategies, scalping has the shortest trading cycle. The volatility of digital assets allows scalpers to make profits on movements from 100 to 200 pips . Orders are opened and closed very quickly, often with the help of trading robots.

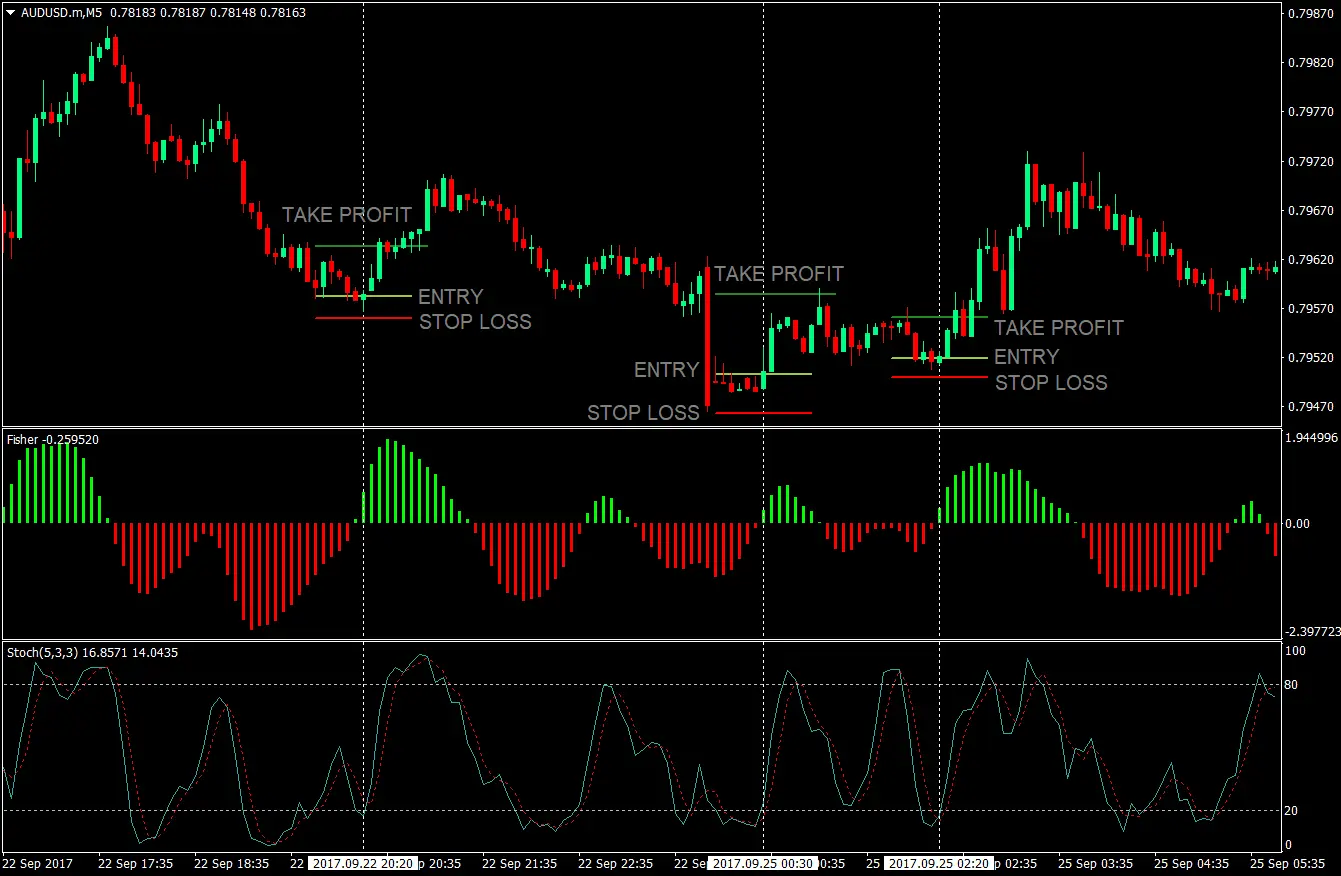

The strategy can be used on the shortest minute timeframes, as well as on longer M5 or M15. The M1 timeframe usually has a lot of “noise”, not allowing for making an objective assessment of the market. Considering that, one can use several time intervals simultaneously to see a more objective picture. For example, in the timeframe M15 there are considerably fewer false signals, and technical analysis can be applied more efficiently.

As scalpers have very little time to make a decision, they need to work out a clear algorithm of actions. For this purpose, a trading system comprising the full set of trading rules is used. In this case, every trader should have his own system according to their preferences, basic character traits, time available for trading, and so on.

More Technical Analysis

For a more accurate analysis, it is necessary to use a set of indicators together. Using only one indicator is not recommended, as it will yield less reliable results.

The scalper's arsenal of technical analysis should include:

- A variety of chart types (line, bar, candlestick);

- Support and resistance levels;

- Trend lines;

- Pivot and continuation patterns (chart patterns and candlestick patterns).

Use of Leverage to Boost Profits

Scalpers often use leverage to increase their profits. Since scalping requires a lot of capital, margin can have a favorable effect on a trader's success.

How Does Crypto Scalping Generate Profits?

Scalping aims at as many profitable trades as possible. Scalpers achieve results by increasing the share of successful trades in the total amount of executed trades. On average, positions are opened for 5-10 minutes, which means that profit on each trade is limited (by contrast, investors’ profit on a trade is theoretically unlimited).

So scalping is all about finding small opportunities in the market and exploiting them. Sometimes these strategies can easily become unprofitable once they become publicly available. That is why it is important to create and test your own unique strategy.

Scalp Trading vs. Day Trading

Unlike scalpers, who make dozens of trades a day, the day trader most often does not trade on timeframes of less than an hour. Thus, intraday traders usually do not conclude more than a few deals a day. If there are no favorable conditions, they do not place orders at all.

It is also important to mention that day traders do not keep their positions open longer than a few hours. They close all positions before the end of the day to avoid rollover fees and unexpected changes in prices.

Types of Crypto Scalping Strategies

There are many popular scalping strategies out there. Some of them are suitable only for advanced and professional traders. We have picked relatively uncomplicated strategies, easy even for novices to comprehend.

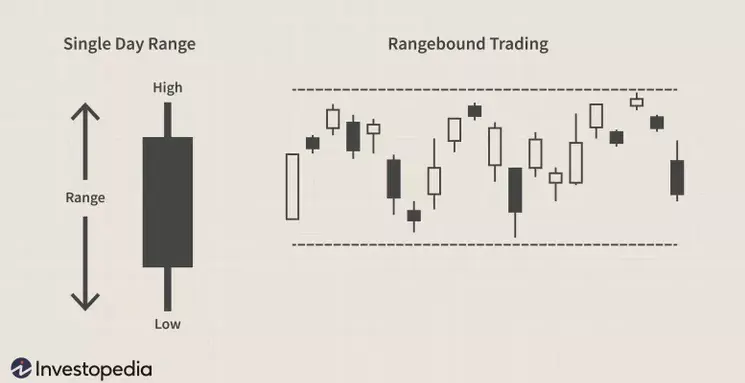

Range Trading

Some scalpers employ a strategy known as range trading. They wait for the price to fix in a set price range and then trade within that range. The idea is that as long as the range is not broken, the bottom of the range will be the support line and the top will be the resistance line.

Range trading is not a guarantee of success, but it still allows you to trade quite profitably. That said, experienced scalpers are always prepared for a range breakout and set stop losses.

Bid-Ask Spread

Another scalping technique is the use of a bid-ask spread. It implies that scalpers can profit from the difference between the highest buy price (bid) and the lowest sell price (ask) in the order book. This strategy is more suitable for algorithmic or quantitative trading.

Arbitrage

Arbitrage strategy implies that a trader profits from price differences on the same assets by buying and selling them on different markets. There are two types of arbitrage trading — spatial arbitrage and pair arbitrage. In the cryptocurrency market, arbitrage is the most effective due to the volatility of digital assets.

Price Action

This method is based on studying the price movement of an asset. The trader must be able to mark and interpret it. Scalping the markets using price movement is not much different from trading with other strategies based on price behavior.

Margin Trading

Margin trading is often used to increase the profitability of transactions with small price differences. However, the leverage increases not only the potential income but losses as well. In addition, sometimes a fee may apply to trades with leverage.

Scalping Indicators Overview

There is no perfect set of indicators used by active investors for cryptocurrency scalping. Crypto investors usually use a combination of technical indicators and momentum indicators.

Below, we provide information about a few popular indicators. Remember that you don't have to use them all at once. Using too many indicators does not guarantee that your trading will be profitable. On the contrary, you may even experience so-called "paralysis" due to conflicting signals.

Moving Average (MA)

Moving averages help traders to identify price trends.

Most often, two or three moving averages with different periods are used as indicators.

Relative Strength Index (RSI)

This technical indicator determines the strength of price trends and the probability of their change.

With this indicator, one should look for divergence and failed reversals. Breakouts of RSI trend lines drawn indicate the entrance points for new trades.

Support and Resistance Levels

Support and resistance levels are lines that each trader sets individually on a certain timeframe, using the price minimums and maximums. The support line indicates the level where demand is strong enough to prevent the price from falling further. The resistance line represents the level at which supply is strong enough to prevent the stock from moving further up. When either a support or resistance line is broken, it reverses its role.

Sometimes there are situations when the same level is both support and resistance for the price, and professional scalpers look for such levels. Working with support and resistance levels is very simple and allows you to scalp with pending orders, which saves much time.

Other Trading Indicators

In general, scalpers often use oscillators that show whether an asset is overbought or oversold. Among such indicators are the following:

- Stochastic Oscillator;

- Williams' Percent Range (WPR);

- Average True Range (ATR);

- Commodity Channel Index (CCI).

Scalping Crypto Tools

Bots

Developing a scalping crypto strategy for your portfolio requires advanced skills and a huge amount of time. Trading robots save a great deal of time and can be used by beginners. The tool also reduces the impact of emotions on trading and could be a great way for proper portfolio management.

A trading robot is essentially a program that connects to the terminal and independently performs the necessary trading tasks. Bots can be used in any terminal with API support (Application Programming Interface), which is used to connect to an exchange.

Signals

Some professional traders which succeed in scalping provide signals highlighting potential entrance points. Signals are sent via email, social media messages or the trading platform.

Technical Indicators

As it was already mentioned above, technical analysis is extremely important for scalping. Among the most widely used indicators in scalping are moving averages, bollinger bands, and oscillators. They can be used individually or combined.

Crypto API tools

Advanced traders use trading terminals, which are third-party applications that work with the exchange via an API interface. The trading terminal is designed to transmit the trader's orders to the platform. It also allows the user to monitor in real-time their profits and losses.

Depending on the type of terminal, the trader will be assisted with a set of additional services to make trading decisions.

Crypto Trading Charts

Last but not least, the trading charts themselves are one of the key trader's tools. A trading chart as a graphical representation of price changes is one of the basic and most essential tools of technical analysis. By studying charts, traders are trying to find patterns to predict future market movement.

Best Time Frame for Scalping

As the crypto industry is open 24/7, there is generally no specific best time frame for scalping. But the choice of the timeframe may vary depending on the asset. Most often scalpers trade on timeframes from 15-minute chart to less than one-minute charts. Beginners usually trade within a 5-minute timeframe, while more advanced traders use a timeframe of up to 3 minutes. In timeframes of less than a minute, only high-frequency trading bots are used, as a human can no longer keep track of the chart movements.

How to Set up a Cryptocurrency Scalping Strategy?

You can start setting up your personal scalping strategy by following these steps:

- Choose trading pairs for scalping. Make sure to take into account the liquidity and volatility of the assets;

- Register on a trading platform that supports your favorite trading pairs. Also, the exchange must have high volumes and low commissions, preferably;

- At the beginning, use a demo account to develop and test scalping strategies until you find a working one;

- Always use a stop loss, especially with leveraged positions;

- Consider a trading bot. In doing so, select a trading bot that allows you to execute a wide range of strategies based on technical indicators.

Pros Of Scalping Crypto

Having analyzed cryptocurrency scalping, we can objectively assess the strengths and weaknesses of this strategy. Let's start with the advantages:

- Potentially high returns in a short period;

- Minimal risks of losing the entire deposit;

- Earnings on any market movements;

- No significant start-up capital is required;

- No knowledge of Fundamental Analysis is required.

- Easy predictability of trading results.

Cons Of Scalping Crypto

However, scalping has a number of important disadvantages:

- It requires a lot of free time;

- Trading is often done with leverage, which increases the risks;

- It requires the ability to concentrate and psychological resistance to stress;

- Commissions. The exchange will take a percentage for each of the buy/sell transactions, and in scalping the number of transactions is huge;

- It requires the ability to react instantly to the market and make quick decisions.

But the most important disadvantage is the significant risk due to volatility. A significant number of transactions have a chance of success of about 50%. The bet is on speed and quantity, not quality. Therefore, it is critical for scalpers to keep track of the number of profitable and losing trades.

Scalping Crypto Tips

Scalping is not the best trading strategy for beginners because it involves quick decisions, constant monitoring of positions, and frequent trades. Nevertheless, there are a few tips that can help beginner scalpers.

Demo Account

Before you start trading with real money, we advise you to use a demo account. A demo account has virtual funds on it. These are not real tokens, so you can't withdraw them. But the assets can be used to make any type of trading transaction. A demo account will help you try scalping and see if this type of trading is right for you. With a demo account, you can test your personal scalping strategy and make sure you don't incur heavy losses with the real trades.

Fees & Costs

Don't forget about the costs of making trades. Scalping involves many trades — up to a hundred per trading session. That is why it is crucial to choose a trading platform that offers fairly low transaction fees.

Conclusion

Despite its complexity, scalping is a fairly common short-term trading strategy that involves profiting from small price fluctuations. This trading technique requires discipline, market deep understanding, the ability to make quick decisions, and psychological stability.

And if you are a beginner, you can use a demo account to see if this style of trading suits you.

All in all, scalping can be an extremely effective and profitable trading style. However, it is important to understand that scalping is hard work. Scalpers earn by the number of trades they make. The more they work, the more potential profit they make.

FAQ

Is Crypto Scalp Trading for Everyone?

The crypto scalping strategy is not suitable for everyone and requires a sufficiently deep understanding of how the market works. If you do not have sufficient knowledge of technical analysis, or you lack educational resources that can help you have a grasp of it, scalping can seem like a rather complicated trading strategy. Before you master it, you might want to take professional trader training courses.

Is Scalping More Profitable Than Other Strategies?

Theoretically, yes the success rate is great. After all, by making a profit on all small fluctuations wit many trades per day, the scalper can quickly increase their capital and, invariably, increase the value of their portfolio. However, the possibility of quick profits in large quantities is always accompanied by increased risk.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.