Chainlink (LINK) Price Prediction 2023, 2025, 2030 - Attempt at Forecast of Future Price

Chainlink Price Prediction

At first glance, it is impossible to predict the future price of an asset, but we can make assumptions about the future value of certain digital assets based on historical data, economic forecasts, and the technology behind the asset.

This article attempts to analyze the future price of the decentralized Chainlink oracle. Given the high demand for Chainlink’s infrastructure in blockchain development, the crypto market participants are beginning to wonder how high its price could go in the coming years.

By the end of this review, you will have an idea of what the community sees as a future for Chainlink in terms of the price of its LINK token. However, please keep in mind that the intention of this article is only to present the opinions of the market experts/analysts.

What is Chainlink (LINK)?

Chainlink is a Web3 platform that facilitates the secure data transfer between various blockchain networks and external systems via smart contracts. The connection between the networks and real-world information is enabled by the Chainlink's decentralized oracles, which gather information from multiple sources.

Having a whole ecosystem of oracle networks, Chainlink presents a multitude of applications, including price feeds, proof or reserve for auditing the assets' collateralization, automation of transaction execution, e-signature, and others.

For example, Chainlink’s Price Feeds allow smart contracts of decentralized applications to receive quotes for various cryptocurrencies from numerous oracles and data sources. This information is crucial when exchanging one cryptocurrency asset for another through a decentralized exchange.

Chainlink is the largest provider of decentralized oracles in the cryptocurrency industry. The technology is particularly in demand in decentralized finance. Also, oracles are used by large companies outside the blockchain industry.

Chainlink Overview

Here is a brief overview of the Chainklink coin from the PricePrediction website.

Smart contracts

Smart contracts are software code or algorithms on blockchain that are programmed to execute when certain conditions are met. Smart contracts perform tasks ranging from trading tokens to managing decentralized organizations, and are therefore the backbone of the entire decentralized finance (DeFi) industry. Decentralized applications (DApps) typically operate through the use of smart contracts.

Oracles

In order for a smart contract to be executed, its terms and conditions should be verified with the real data. The correct operation of smart contracts and DeFi as a whole depends on the accuracy of the data they receive. The slightest data error can cost hundreds of thousands of dollars. However, smart contracts cannot autonomously fetch the data outside the blockchain. That is why, most smart contracts rely on external sources.

To retrieve external data, smart contracts use oracles. Working as middleware, oracles transfer information to the smart contract from external resources. With oracles, the scope of use of smart contracts is virtually limitless. Moreover, they protect smart contracts against data manipulation and downtime.

History of Chainlink

Chainlink first became known in 2017, when Sergey Nazarov and Steve Ellis released its white paper. In the same year, they brought in the former Google executive Eric Schmidt as an advisor. The project was officially launched in 2019. It focused on the technology of decentralized oracles based on nodes.

Chainlink technology was developed jointly with Cornell University professor Ari Juels. Ari now works with the founders and other team members at Chainlink Labs. Their main goal is to develop the protocol and the architecture of the project.

Who Is Behind Chainlink?

Chainlink has one of the most technically savvy teams in the industry and consists of world-class developers. The team also invites consultants from leading research institutions.

The team consists of the following leading members:

- Sergey Nazarov. Co-founder and CEO. He also founded SmartContract in 2014, the cryptocurrency exchange Secure Asset Exchange, and the decentralized email service CryptoMail.

- Steve Ellis. Chief Technology Officer of the company. He also co-founded the Secure Asset Exchange company with Nazarov.

- Ari Juels. A consultant who helped in creating the white paper. He is a professor of computer science at Cornell University. Previously served as a director at the IC3 crypto project.

- Andrew Miller. Technical Advisor. He is a professor of computer science at the University of Illinois.

What's The Point of Chainlink?

Chainlink developers have made technology that forms channels between different data providers and blockchain smart contracts. Chainlink has created decentralized oracles that guarantee the execution of smart contracts between the crypto-infrastructure and third-party data sources. Their main strengths are the absence of a single data source and the resistance to price manipulation since they are not regulated by anyone or anything.

A smart contract connected to the Chainlink network requests information from several oracles at once in order to get the most reliable data possible. For this reason, decentralized Chainlink oracles are also called consensus oracles.

What Is Chainlink Used for?

The project helps blockchains interact with each other as well as with external data sources through oracles. The oracles feed information about real-world events, such as transactions or off-chain payments, to smart contracts.

For example, if there is a soccer match between two teams tomorrow, two friends can make a bet between themselves. They create a smart contract and connect it via API to a reliable sports resource. Both fans transfer the amount they wagered to the smart contract. A condition is created that, if team A wins, the smart contract will transfer the money to fan A, if team B wins — to fan B. Then Chainlink oracles will get the information about the outcome of the match from reliable sources and transfer it to the smart contract. The contract will then fulfill the set condition and transfer the money to the winner of the bet.

Who Uses Chainlink?

The Chainlink project has partnered with such industry giants as SWIFT, Google, Oracle, Gartner, NBA and IC3. As of August 2023, the Chainlink ecosystem consists of more than 1,800 projects running on 15 blockchains.

In order to encourage growth of blockchain ecosystems, promote security and grow their TVLs, Chainlink introduced several initiatives as a part of its Economics 2.0. Since the introduction of the initiatives, numerous early-stage Web3 projects joined the Chainlink programs BUILD and SCALE.

The project’s Price Feeds, providing crucial market data, are used by leading DeFi protocols: Aave, Synthetix, Lido, Ampleforth, Celsius Network, Loopring, oxProject, and others. Blockchain games ustilize Chainlink's oracles as a source of on-chain randomness to mint in-game NFTs, distribute rewards and create unpredictable scenarios.

With Chainlink Automation, smart contract developers can automate the triggering of smart contract functions to a decentralized network of nodes.

How does Chainlink (LINK) Work?

Chainlink uses a network of oracles to provide smart contracts with secure access to data. The whole process is divided into three distinct steps.

- Oracle selection. Chainlink users initiate the generation of a smart contract, known as a Service Level Agreement (SLA), which specifies a set of data requirements. The software then uses the SLA to match the user with oracles that can provide the required data.

- Data Reporting. In this step, oracles connect to external sources and obtain the real-time data requested in the SLA. The data is then processed by the oracles and sent back to the contracts running on the blockchain, which uses Chainlink oracles.

- Aggregation of results. In the last step, the data is collected from the selected oracle. The data is then either verified or reconciled to ensure the accuracy of the results. The Chainlink aggregating subcontract can collate, verify, and reconcile data from one or more sources. If any source is incorrect or dishonest, its data is rejected.

Chainlink Critics

Despite the fact that Chainlink plays an important role in the blockchain industry, the project also had its downfalls. For example, a number of issues during its ICO in September 2017 resulted in the team being able to raise only $3 million instead of the planned $16 million. The poor organization of the ICO led to negative reviews from the cryptocurrency community.

Some critics claim that Chainlink has some technical flaws. Eric Wall, CIO of Arcane Assets, sharply criticized Chainlink 2.0's technical document, arguing that Chainlink is not “cryptoeconomically secure”. By his definition,

“For something to be cryptoeconomically secure, you must have a guarantee that the particular entity you rely on loses something of concrete value that they currently already own that is worth more than what they make from defrauding you.”

In August 2020, an organization called Zeus Capital LLP published a report called The Chainlink Fraud Exposed , which detailed the components of the project. The main conclusion made by the anonymous authors was that the LINK project token was overvalued at the time. However, this and other points in the report were later rebutted by a Chainlink supporter.

LINK Tokenomics

The total supply of LINK is capped at 1 billion. Currently, the circulating supply of tokens is 538 million LINK, which has a market capitalization of USD 3.2 billion according to Coinmarketcap.

Based on the ICO documentation, the distribution of coins is as follows: 35% to the node operators and for stimulating the ecosystem; 35% sold at the ICO; the remaining 30% is used for the development of the Chainlink ecosystem.

Chainlink Native Token Overview

LINK is an ERC-20 token. It is used mainly to pay the operators of the Oracles’ nodes. Here is a brief overview of the Chainlink coin from the Coinmarketcap website.

Chainlink (LINK) Price History

From the Chainlink/USD price chart, we can see that since May 2022 when Chainlink returned to mid-2020 levels, it has been in a prolonged sideways movement. Its value jumped more than 50% in July-August 2022 and reached the $9.6 mark, in just two weeks, it fell by more than 35% by August 22.

In 2023, the lowest point was registered at $5.24 in June, with the following rise of 64% up to $8.14 in the end of July. However, after that, following the general trend of the cryptocurrency market, the asset gradually declined in value. The current price of Chainlink (as of the end of August 2023) is $5.95 and the trading volume is $145 million, which is almost twice as low compared to $284 million in 2022. LINK is currently ranked 22nd in the Coinmarketcap with a market capitalization of $3.2 billion.

During the Chainlink ICO, the price of the LINK token was only $0.11 per LINK. Soon after LINK started trading on the market, in November 2017, the price reached the $0.17 mark. After that, it fluctuated in a wide range from $0.15 to $0.43 for a month until the end of December. In January 2018, the price already exceeded $1.

On January 23, the token price broke below the $1 level and continued to decline, fluctuating between $0.2 and $0.6 in February and March. The price held around $0.3 for most of the year, reaching $0.4 again only in October 2018 when LINK was added to the BKEX exchange. A month later, the price returned again to the range of $0.3 where it remained for the rest of 2018. However, it was still significantly higher than the ICO price.

In April 2019, the price reached $0.5 and continued to rise up to $1 by May. In July, the token was added to Coinbase Pro, which caused a significant increase in LINK value. Until mid-August 2019, LINK traded around $2.5, before it plunged again to $1.5 in October. But the ensuing series of listings on LATOKEN, Kraken, and then finally on Binance recovered the LINK's price up to $3 in November. December was not so brilliant. By the end of the month, the price had fallen to $1.5.

Nevertheless, since the beginning of 2020, there was a steady uptrend. In early March, LINK hit a high of $4.9. In August 2020, the price crossed the $10 mark, reached $20, and decreased only in September. Since October, Chainlink's price has never dropped below $10.

In January 2021, the price reached the $20 level again and leaped to the $42.75 mark by mid-April. This month was extremely volatile for LINK, as its price fluctuated between $28 and $41 at that time.

LINK reached its all-time high of $52.88 on May 10, 2021. Shortly after the cryptocurrency ban in China in May 2021, almost the entire cryptocurrency market fell from its historical peak and LINK followed this trend. The bear market continued and by October 2022 the token price had dropped by 90% to about $5. Since then, it has been trading more or less flat for the whole 2023 in a narrow range from $5 to $8.

Experts Share Their Thoughts on Chainlink Price Future

Let’s take a look at some Chainlink price predictions as of August 2023. Keep in mind though that any forecasts may turn out to be wrong.

According to the 1-month price prediction made by CodeCodex, Chainlink will increase in value within its 2023 upper limit to about $8.5 and then bounce to $7.2 shortly after.

The WeStarter forecast for LINK is slightly less optimistic, suggesting values between $7.164 (high) and $5.413 (low). And the Trading View technical analysis shows a negative sentiment for LINKUSD in terms of one week, as well as in terms of a month. For a real-time update of the sentiment, click here.

Chainlink Price Forecast

According to the experts, the LINK price could show steady growth year by year and by 2030 could reach the mark of 180 dollars.

Chainlink Price Prediction 2024

According to predictions on the websites Changelly.com, Priceprediction.net, Technewsleader.com the next LINK values in 2024 will be:

Chainlink Price Prediction 2025

According to predictions on the websites Changelly.com, Priceprediction.net, and Technewsleader.com the next LINK values in 2025 will be:

Chainlink Price Prediction 2026

According to predictions on the websites Changelly.com, Priceprediction.net, and Technewsleader.com the next LINK token price in 2026 will be:

Chainlink Price Prediction 2027

According to predictions on the websites Changelly.com, Priceprediction.net, and Technewsleader.com the next LINK values in 2027 will be:

Chainlink Price Prediction 2028

According to predictions on the websites Changelly.com, Priceprediction.net, and Technewsleader.com the next LINK values in 2028 will be:

Chainlink Price Prediction 2029

According to predictions on the websites Changelly.com, Priceprediction.net, and Technewsleader.com the next LINK values in 2029 will be:

Chainlink Price Prediction 2030

According to the websites Changelly.com, Priceprediction.net, Technewsleader.com, the Chainlink cryptocurrency price prediction for the year 2030 is as follows:

Chainlink Price Prediction 2040

According to WeStarter, Chainlink can reach $47.824 in 2040. The lowest point is predicted to be at $34.640, and average values hovering around $39.049.

It’s important to note that most experts do not provide such long-term estimates. We may assume various scenarios for the future. They all depend on a huge number of factors, including the economy, regulation, etc. We also may not be sure if the project continues to exist in 20 years time. We can not dismiss the possibility that the project will develop into something completely different.

Chainlink Future Price Prediction in 2050

The experts from WeStarter say that LINK could be $58 n 20-30 years. The lowest value we might witness is expected to be around $41. But again, the community is cautious about making such far-fetched predictions. That is why you need to take these forecast with a healthy degree of skepticism.

How To Read And Predict LINK Price Movements?

Understanding and predicting cryptocurrency prices require a thorough analysis of various indicators and chart patterns. It will not only unveil the intricacies of price action, but also empower you to forecast potential future movements with a higher degree of confidence.

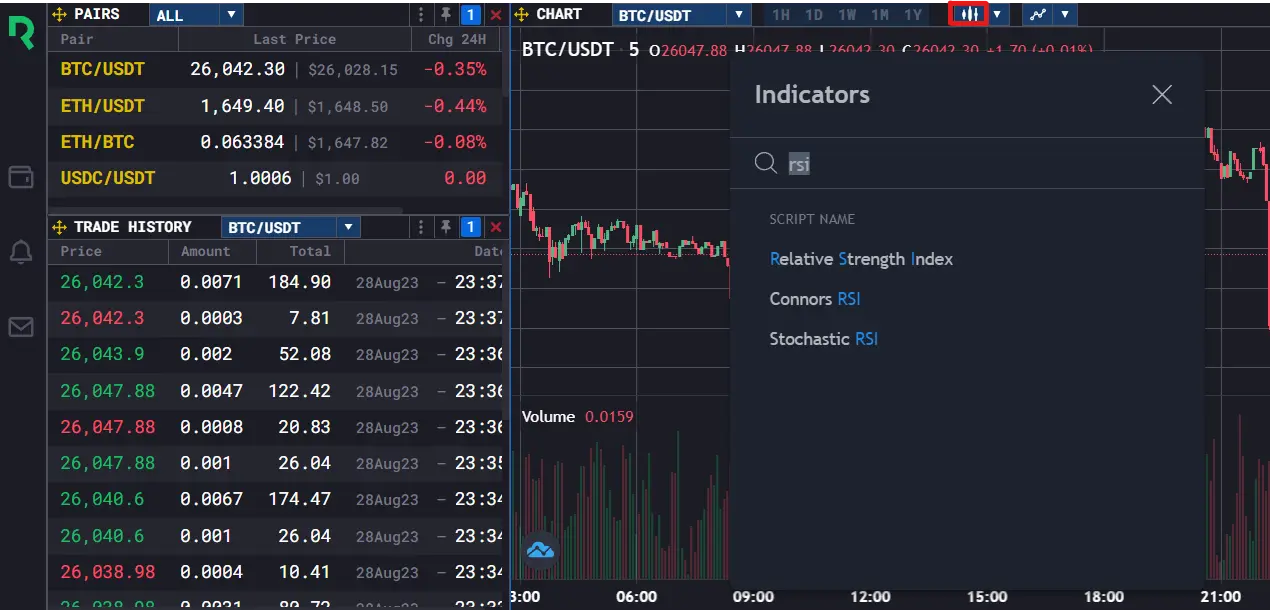

Some of the most popular indicators are the MA (moving average), stochastic and RSI (Relative Strength Index). You can apply a desirable indicator on the Redot exchange by clicing on the indicator icon and then typing the name of the indicator in the search bar.

The RSI, for instance, measures the speed and change of price movements on a scale of 0 to 100. Traditionally, RSI is considered overbought and indicating a potential downtrend when above 70 and oversold (assuming a potential uptrend) when below 30.

As for chart patterns, one of the examples is a “cup and handle”, which signals that an upward trend is likely to continue after a brief consolidation. You could learn about different patterns from our comprehensive guides, such as Japanese candles chart, bear flag and reversed cup and handle patterns.

It is best to test one's forecasts based on indicators first, without purchasing LINK, to see how accurate the forecasts are. The same advice goes for chart patterns.

Conclusion: What Could Chainlink Be Worth?

Chainlink's fundamental oracle technology benefits a huge number of blockchain projects and stimulates the ecosystem’s growth. Its innovativeness and huge ecosystem makes the native token LINK a potentially profitable investment for the future.

Based on a review of experts' forecasts, we can conclude that the price of Chainlink (LINK) could show steady growth. Thus, already by the end of 2023, Chainlink (LINK) may rise to $7.70, and in a couple of years its minimum price could be $18, and the maximum — $21.17 per LINK. In the long term, Chainlink could reach a maximum value of $144 by 2030.

However, one should keep in mind that Chainlink's future is highly dependent on the overall state of the cryptocurrency market. As with all crypto investments, there are risks involved, and it is essential to do thorough research and consider various technical indicators and resistance levels before investing in Chainlink. Overall, LINK might be a great choice for those with a high risk tolerance and strong financial position.

FAQ

Is Chainlink a Profitable Investment in 2023?

As a pioneering oracle service, Chainlink seems poised to continue dominating the off-chain data implementation market. Hence, it is expected that LINK will only get stronger going forward. However, the value of LINK is also highly dependent on the overall crypto market sentiment.

What Price Will Chainlink Reach in 5 Years?

Experts at Priceprediction assume that the price of LINK will be at least $58.37 in 2028. And the token's maximum value could reach $69.08.

Will Chainlink (LINK) Ever Hit $1000?

It is highly unlikely. Given the total supply of LINK is 1 billion tokens, a price of $1,000 means the total capitalization of the Chainlink project $1 trillion, which exceeds the total size of the cryptocurrency market at the moment.

What Will Chainlink Be Worth in 10 Years?

It is hardly possible to predict any asset’s price accurately several years into the future. The predictions range from the optimistic $250 to pessimistic $26.

What Is the LINK Price Forecast for 2025?

According to Changelly, it is estimated that in 2025, the minimum price of LINK could drop to $18.02 and the maximum — to $21.27. The average trading price will be about $18.65. The highest value of $21.189 suggested by WeStarter is very close to the Changelly’s prediction, while the lowest value is much lower — $10.016.

Is It Too Late to Buy Chainlink?

As a consequence of a bear market, LINK has fallen from its highs by 90%. Trading at its summer 2020 levels, LINK looks like an attractive investing opportunity. This might be a good chance for those who are genuinely interested in the project and have been waiting long to purchase its tokens. At the same time, there is always a risk that the bearish market will persist. The continuing downtrend will affect the value of negatively LINK, too. Please make your own research or seek professional advice before making an investment decision.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.