What Is a Call Backspread?

Trading options involve a wide variety of strategies that traders use to maximize profits and manage risk. One such strategy, known as the call backspread (also referred to as a ratio call spread or call ratio back spread) is primarily used when a trader anticipates a significant upswing in the price of a base asset.

Typically, a call backspread strategy involves initiating a position by selling (writing) one call option and utilizing the premium received to purchase additional call contracts at a higher strike price. This strategy commonly employs ratios such as:

– one at-the-money short call paired with two out-of-the-money long calls (1:2)

or

– two at-of-the-money short calls combined with three out-the-money long calls (2:3)

It is important to ensure that all options involved in the strategy have the same expiry date.

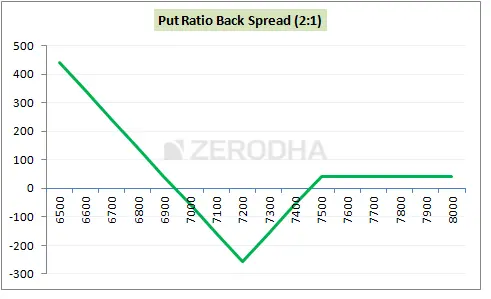

Call Backspread vs. Put Backspread

As mentioned earlier, the call backspread or call ratio backspread is a bullish strategy, favoring upward price movement. On the contrary, a put ratio backspread, also known as a put ratio backspread, tilts towards a bearish perspective. It is used to capitalize on a sharp decline in the price of a base. In essence, where the call ratio spread strategy seeks to gain from the base asset price hike, the put back ratio spreads profits from its depreciation. To sum up the distinction between two strategies:

Call ratio backspread is a bullish strategy. Sell fewer ATM call options, buy more OTM call contracts. Profit from a sharp price increase.

Put ratio backspread is a bearish strategy. Sell fewer ATM put options, buy more OTM put contracts. Profit from a sharp price decrease.

Key Takeaways

- A call ratio backspread is an options' strategy for traders expecting a significant price increase in Bitcoin.

- The strategy involves selling and buying different quantities of call options at distinct strike prices, creating an asymmetric payoff.

- The management of the call backspread depends on market conditions and the trader's market outlook.

- Time decay and implied volatility significantly influence the profitability of a call backspread.

- Volatility skew can affect the potential profitability of the strategy.

- The breakeven points and understanding of risks are essential considerations in this strategy.

- Despite its risks, a call backspread offers potentially unlimited profit in case of a significant upward price move.

Theoretical Framework

Call Backspread Market Outlook

A call backspread essentially thrives in a scenario where there's an expectation of a notable surge in the value of the cryptocurrency. In other words, a trader predicting a significant uptrend in Bitcoin price would find this strategy particularly appealing.

Call Ratio Backspread Expectations

Thus, traders should consider employing a call backspread strategy in the following situation:

- When they hold a bullish market outlook.

- When they expect heightened volatility in the market.

- When they have the ability to establish the strategy with limited upfront cost or even receive a net credit.

- When they have a well-defined risk management plan in place.

Profit Potential

The beauty of a call backspread lies in its unlimited profit potential. The higher the base asset price ascends above the higher strike price, the more profitable the strategy is. Naturally, this brings an exciting dimension to the table for traders optimistic about base asset price trajectory.

Maximum Risk

The maximum risk of the call ratio back spread occurs when the price of the base asset at expiration is between the exrcise prices of the sold and bought call options. Thus, it can be represented by the following formula:

Max Risk = Exercise price of sold call – Price of base asset at expiration – Net credit received

Directional Assumption

In the context of a call ratio back spread, the trader's directional assumption, or the anticipated movement of the base asset price, is bullish. The strategy prospers when the base asset price ascends significantly, driving the options into deep in-the-money territory.

Ideal Implied Volatility Environment

Navigating the volatility currents, an ideal environment for a call backspread emerges when implied volatility is expected to rise. A surge in volatility could inflate option premiums, increasing the likelihood of a profitable exit before expiration.

How to Set Up a Call Backspread

The call ratio backspread involves selling at-the-money call options and buying a larger quantity of out-of-the-money call contracts.

Here are the specific steps for entering a call backspread:

Entering a Call Backspread

- Determine which asset you anticipate will have a significant increase in price.

- Sell 1 (or 2) at-the-money call options. The exercise price of the options should align closely with the current market price of the asset.

- Purchase 2 (or 3) of out-of-the-money call contracts, ideally with a strike price noticeably above the asset's current market price.

- After setting up the positions, verify if you've achieved a net credit scenario. The received premium from the sold call options should exceed the paid premium for the bought call contracts.

Managing a Call Backspread

Monitoring a Call Backspread

Once a call ratio backspread is established, it's not a set-and-forget strategy. Continuous monitoring is essential for success. Regularly monitoring your position allows you to keep track of the movement of the base relative to the strike prices of your call options and assess how these movements affect your overall position.

Monitoring a call backspread involves regularly tracking the price movement of the base asset, assessing volatility levels, considering time decay, and staying informed about market events. By closely monitoring these factors, traders can make informed decisions regarding potential adjustments, exit strategies, or rolling the position to adapt to changing market conditions.

Exiting a Call Backspread

Disengaging from a call backspread requires sharp judgment. It becomes viable when there's a considerable appreciation in base asset price, leading to a scenario where the strategy generates adequate profits. The trader might consider closing the position earlier if the market starts to move against the initial analysis, or if the price of Bitcoin hasn't moved significantly as the expiry date approaches.

Adjusting a Call Backspread

Fine-tuning a call backspread typically happens when market conditions start moving against the initial assumptions, or when the trader wishes to minimize potential losses or maximize gains. Depending on the prevailing circumstances and the trader's judgment, it might involve buying or selling additional contracts, rolling to a different strike price or expiry date, or even switching to a different strategy entirely.

Rolling a Call Backspread

Rolling involves closing the current position and opening a new one, typically with a later expiration. It can be a beneficial tool for managing positions that are not performing as expected.

Effects on a Call Backspread

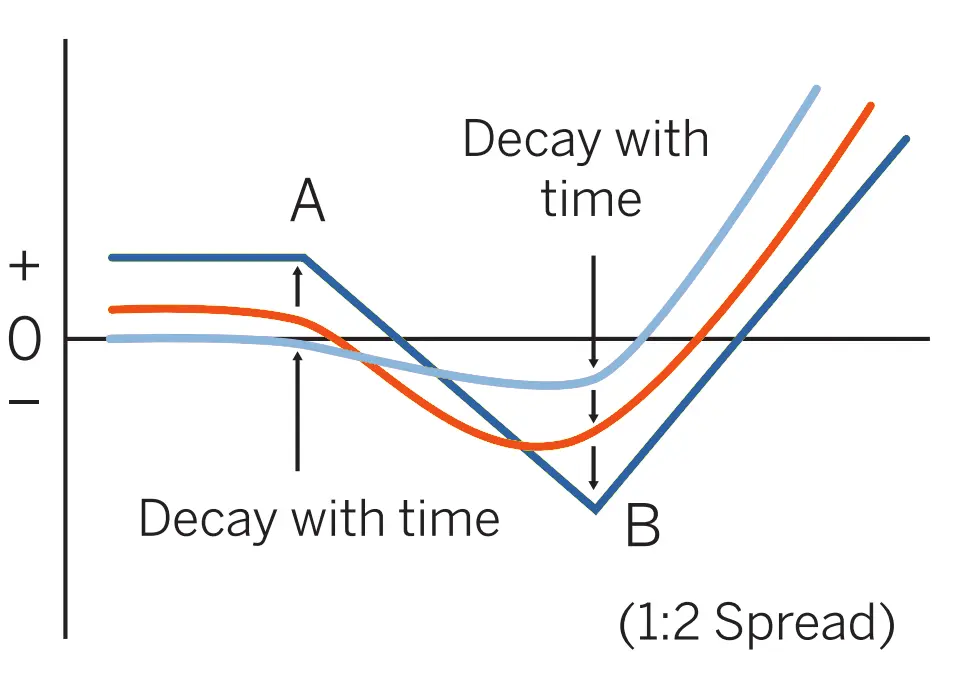

Time Decay Impact on a Call Backspread

As we turn to the impact of time decay, or theta, on a call backspread, it's essential to note that it can be both beneficial and detrimental. In a call backspread, time decay generally works against the strategy, since the more numerous long out-of-the-money (OTM) call options lose value over time.

However, if the base's price rises significantly, this price increase can offset the negative effect of time decay.

Implied Volatility Impact on a Call Backspread

Implied volatility, the market's expectation of future volatility, plays a substantial role in pricing options. A rising implied volatility can be beneficial for a call backspread, as it can inflate the value of the contracts and potentially lead to early profits.

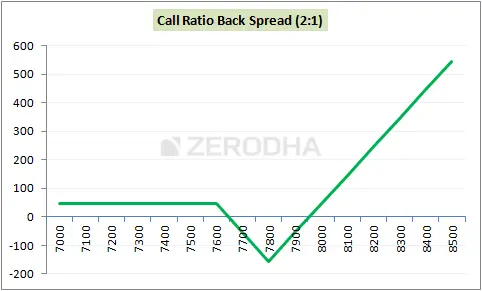

Call Backspread Payoff Diagram

A call backspread payoff diagram is a visual tool that depicts potential profit and loss for this strategy, factoring in the price of Bitcoin at expiration.

How to Read The BCR Profit-Loss Chart

Below, there is the BCR profit-loss chart. If the base asset price is below the lower strike price, the diagram indicates a limited loss. The diagram shows two breakeven points where it intersects with the zero-profit line. Between the two strike prices, the profit or loss varies based on base asset price and the net premium. Lastly, the diagram showcases unlimited profit potential if base asset price surpasses the higher strike price at expiration.

Reading it correctly can offer traders insights into various scenarios, including the maximum loss, breakeven points, and the unlimited profit potential.

Call Ratio Backspread vs. Call Option

A call ratio backspread and a simple call option exhibit distinctive characteristics. The former consists of a combination of options, offering a higher potential profit but requiring a more significant price movement for profitability. In contrast, a call option offers a simpler approach, with profitability commencing as soon as the base asset price exceeds the exercise price plus the premium paid.

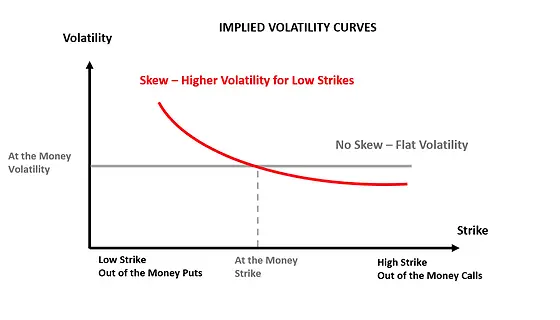

Impact of Volatility Skew on Ratio Spreads

Volatility skew is the difference in implied volatility (IV) for options on the same asset but different strike prices. This skew can greatly impact ratio spreads, which involve buying and selling different numbers of contracts at different strikes.

A steep skew can improve the risk/reward ratio as options sold in a ratio spread may have a higher IV, bringing in more premium.

However, a steep skew can also amplify the risks if the asset price moves significantly against the position.

The profit potential of a spread can be affected too, with higher profits if sold options have much higher IVs.

Changes in the skew over time can positively or negatively impact these trades, along with other factors like asset price movements and options' time decay.

Examples

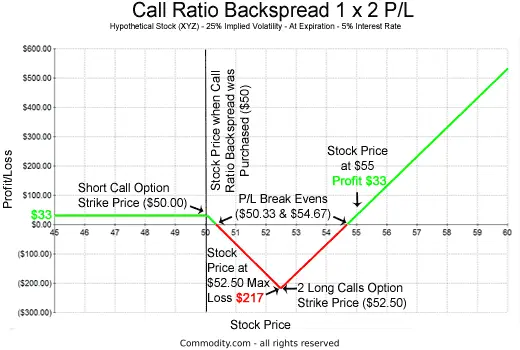

Example of a Call Ratio Backspread

Consider the situation where Bitcoin is currently trading at $20,000. A trader is anticipating a significant rise in Bitcoin’s price over the next few months. So, they decide to implement a call ratio backspread strategy.

In setting up this strategy, the trader sells one Bitcoin call option with a strike price of $20,000 and receives a premium of $2,500. Concurrently, the trader purchases two call options with a strike price of $22,000, paying premiums of $1,200 each.

This setup results in a net credit of $2,500 – (2 * $1,200) = $100, meaning the trader receives $100 after setting up this spread.

Now, let's delve into the possible outcomes at the options' expiration:

- If the Bitcoin’s price is below $20,000, all contracts expire worthless. The trader earns a profit of $100, which is the net credit received.

- If the Bitcoin’s price is between $20,000 and $22,000, only the sold call option is in the money. The trader has a liability under the sold call option, while the purchased options expire worthless. This scenario could lead to a loss for the trader, as the liability from the sold option could exceed the initial net credit received.

- If Bitcoin’s price is above $22,000, all options are in the money. The trader incurs a loss on the sold call option but profits from the two purchased call contracts. As the price goes beyond $22,000, the profit from the purchased call options keeps increasing, offering potentially unlimited profit.

The breakeven points in this strategy are at $20,000 and $22,000 * 2 - $100 = $43,900. If Bitcoin’s asset price is at either of these levels at expiration, the trader breaks even.

Conclusion

The call ratio backspread serves as a powerful tool for traders expecting a significant surge in an asset's price, like Bitcoin. With its potential for unlimited profits and a variety of management techniques, it offers flexibility in a volatile market. However, potential losses should be well understood and mitigated where possible.

Frequently Asked Questions (FAQs)

Is a Ratio Spread Profitable?

Like any strategy, a ratio spread can be profitable if the base asset's price moves as anticipated. In a call ratio backspread, profitability requires a substantial price increase.

What’s a Back Spread in Options?

A backspread in options is a strategy involving selling fewer options than are bought, expecting a large price move. A call backspread is used when the expected move is upwards.

What Is a Bitcoin Call Backspread Strategy?

A Bitcoin call backspread strategy involves selling call options at a lower exercise price and buying a larger quantity of call contracts at a higher strike price, expecting a significant increase in base asset price.

How Do I Profit From a Bitcoin Call Backspread?

To profit from a Bitcoin call backspread, you need a significant upward move in the price of Bitcoin. The strategy profits when the base asset price is substantially above the exercise price at expiration.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.