Calendar Spread Options Trading Explained

Options are commonly used by cryptocurrency traders to diversify their portfolios and hedge positions. For successful options trading, you typically find a strategy to predict the direction the asset is likely to move. The optimal strategy should suit you in terms of risk/return ratio and satisfy other parameters set by you.

However, there are strategies that do not require you to predict the direction of the market. One of such strategy is called “calendar spread”. It lets you make a profit when the asset price does not move much. The nuances, mechanisms, key points, and application of this strategy will be covered in this article.

Key Takeaways

- A calendar spread strategy is typically used when the asset is expected to trade in a narrow range.

- To implement a calendar spread strategy, a trader opens two call/put positions which have the same strikes but different dates of expiration.

- The maximum loss of the strategy is equal to the difference between the premiums paid for the long option and received from the short option.

What is a Calendar Spread?

The calendar spread is a strategy that involves purchasing one option which expires further in the future and selling another with a nearer expiration date. Both options have identical underlying assets and strike prices.

The strategy also goes by the names of “horizontal” and “time spread”. It takes advantage mainly of the time decay (or theta decay) and the increased implied volatility (IV).

In general, calendar spread can be applied not only to options but also to futures trading. This article will focus on the use of the strategy with options.

How Does a Calendar Spread Work?

The main purpose of the calendar spread strategy is to effectively exploit the differences in time decay and volatility between the two options. Below, we will explore these and other main factors which affect the strategy.

Theta Decay Impact

Theta decay, or time decay, is a critical element of the calendar spread strategy. It is a measure of the rate at which the value of an option decreases over time. The drop in the option’s value typically accelerates as the option nears expiration.

That is why long options have a negative theta (they lose value with time for buyers), while short options have a positive theta (their value increases for sellers as time goes by). The profitability of a calendar spread depends mainly on the difference in the time decay between the two options.

Implied Volatility Effect

Another key element of the strategy, implied volatility, is the forecasted volatility of the asset price. It heavily influences the effectiveness of a calendar spread strategy.

If the implied volatility of the longer-term option is higher than that of a shorter-term option, the strategy will be profitable. By contrast, if the implied volatility of the options is comparable, the strategy's profitability may be limited.

The Greeks

The theta mentioned above belongs to a set of measures called the Greeks. Other Greeks that affect the profitability of a calendar spread strategy are delta, gamma, and vega:

- Delta measures the sensitivity of an options’ change in price to the changes in the price of the underlying asset.

- Gamma measures the rate in the delta change related to the change in the asset price.

- Vega measures the sensitivity of an option’s price to changes in implied volatility.

Breakeven Point

Different approaches can be used to calculate break-even points for a calendar spread strategy. The calculations will depend on the type of options involved in the strategy.

- Calendar spread with calls: the breakeven point will be equal to the strike price + the premium paid for the long option – the premium received for the short option

- Calendar spread with puts: the breakeven point would be equal to the strike price – the premium paid for the long option + the premium received for the short option

Although, in general, breakeven points can be roughly calculated using the formulas above, certain market conditions, such as changes in volatility, may cause the breakeven points to change subsequently. Therefore, in general, their calculation can be quite complicated, and the accuracy of the calculations can vary greatly depending on market conditions and the models used.

Sweet Spot

The price of the asset most optimal for the maximization of the strategy profit is called the sweet spot. In terms of a calendar spread, this point is reached when the short option is executed “in the money” or slightly “out of the money”. In this case, the short option has zero value (which is an advantage for an option seller), and the long option still has a time value.

Margin Requirements

The calendar spread strategy generally has lower margin requirements when compared to other options trading strategies. In other words, the trader may be required to have less money in their trading account to execute a calendar spread than they would for other options strategies with a similar risk profile.

Special Considerations

While using a calendar spread strategy, it is crucial to consider the liquidity of the options. Both options should have sufficient liquidity to ensure instant execution. Another important point is the implied volatility of the options. For profit maximization, the chosen options should have a significant difference in implied volatility.

Maximum Loss on a Calendar Spread

The maximum possible loss that a trader can incur on a calendar spread is limited to the net debit. It represents the difference between the price paid for the longer-term option and the price received from the sale of the shorter-term option. This means that the trader can only lose the amount they paid to initiate the strategy.

Calendar Spread Strategy in Options Trading

To implement a calendar spread options strategy, traders can use either “call” or “put” options, depending on their outlook on the underlying asset's direction. The strategy consists of purchasing a longer-term option while simultaneously selling a shorter-term option. Both these options should have the same strike price.

Calendar Spread Setup

Here are the steps to set up a calendar spread strategy:

- Choose the underlying asset;

- Determine the desired expiration dates for the options;

- Select the strike price;

- Buy the longer-term option (open a long position);

- Sell the shorter-term option (open a short position);

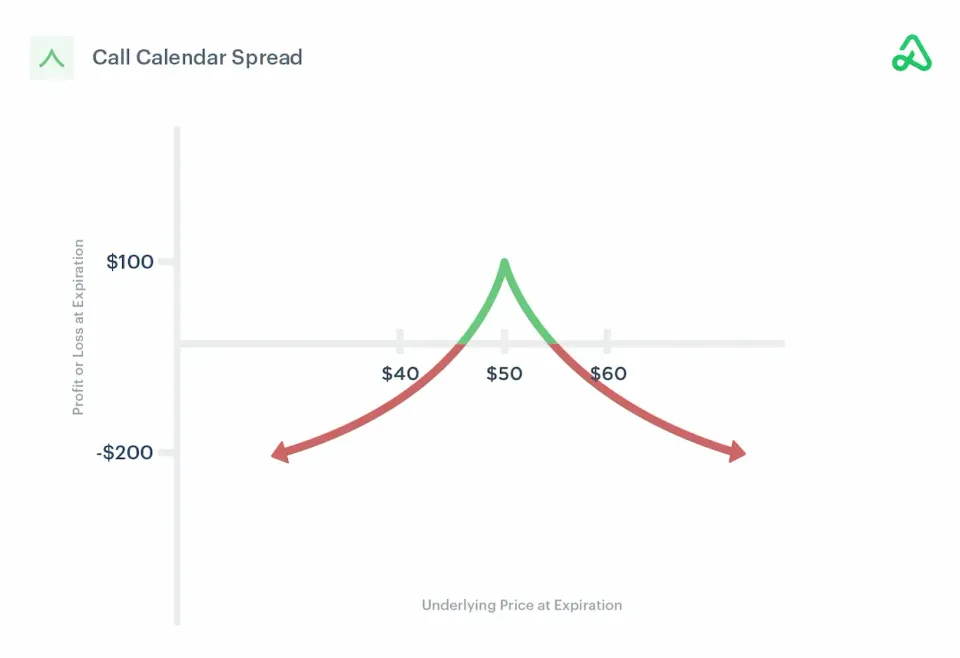

Calendar Call Spread

A calendar call spread is considered to be a bullish options trading strategy. The strategy involves buying a longer-term call option and selling a shorter-term call option with the same strike price. The trader profits if the underlying asset's price remains stable or increases.

Converting to a Bullish Call Option

In case the price of the asset begins to rise, then the trader can use the strategy “Converting to a bullish call option” to protect his position. To do this, they can sell a short call option and simultaneously buy a long call option with a higher strike price. Thus, the trader can switch from the calendar spread to a more secure position in the form of a call option with a higher strike price.

Calendar Put Spread

A calendar put spread is a bearish strategy that involves buying a longer-term put option and selling a shorter-term put option. Again, both options should have the same strike price. The trader benefits if the underlying asset's price remains stable or decreases.

Converting to a Bearish Put Option

As with call spreads, in case of forecast alterations, the calendar put spread can be converted into a bearish put option. That is, the trader closes a position in a short put option with a nearer expiration. Then, they open a new short position with a lower strike price put option that expires at the same time as the long put option. Therefore, the new put option will have a lower strike price, reflecting the trader's bearish preference.

Double Calendar Spread Setup

There is also a more complex version of the calendar spread strategy. This is the so-called double calendar spread, involving the purchase and sale of two calendar spreads with different strike prices.

Such a strategy can be used to make a profit when the price of the underlying asset moves up or down significantly.

Who is the Calendar Spread For?

As we stated at the beginning of this article, the calendar spread strategy is best suited for traders who expect the price of the underlying asset to remain stable. It will also suit you if you are planning to trade in a narrow range.

When to Use the Calendar Spread

The strategy can be used when two conditions are met:

- There is a significant difference in implied volatility between the two options.

- The price of the underlying asset remains stable or trades within a narrow range.

Calendar Spread Examples

Here are some examples of calendar spreads:

Long Call Calendar Spread Example

Suppose Bitcoin is trading at $20,000, and the trader expects the price of BTC to remain stable over the next 3 months and rise over the next 3-6 months. The trader buys a call option with an expiration date of 6 months and an exercise price of $20,000 for a $1,000 premium. They simultaneously sell a Call option with an expiration date in 3 months and the same exercise price for a $500 premium. In this case, the trader will receive the maximum profit if the BTC price starts to grow after the expiration of the nearest option.

Further actions will depend on the market situation. If the price of Bitcoin rises, the trader can either lock in profits and close the position or hold it until the expiration of the long-term option. On the other hand, if the price begins to fall, the trader may decide to close the position with a small loss. Alternatively, they can take additional risk management measures, such as applying defensive strategies or adjusting their position.

Long Put Calendar Spread Example

The scenario for the long put strategy will be the opposite. Let's say a trader purchases a put option on Bitcoin with a strike price of $20,000 that expires in six months for a $1,000 premium. At the same time, they sell a put option with the same strike price that expires in three months for a $500 premium. As a result, the net debit paid for the spread is $500. If the price of BTC remains at $20,000, the trader can benefit from the shorter-term option's time decay and the longer-term option's implied volatility.

Reverse Calendar Spread With Calls and Puts

The reverse calendar spread strategy is focused on profiting from the price difference between the strike price and the asset price. This in contrast to long calendar spreads, which allow profiting from smaller price movements.

With this strategy, you open two call or put positions with the same strike prices. Basically, you are selling a longer-term option and buying a shorter-term one. Since the longer-term option has a higher premium, your net premium will be a credit.

For instance, you can sell the longer-term option with 60 days to expiration (DTE), and buy the shorter-term option with 30 DTE. The credit will be the premium.

Reverse Calendar Spread With Calls

“Reverse Call Calendar Spread” is a strategy in which the trader sells a call option with a longer expiration time and, at the same time, buys a call option with a shorter expiration time. This is the opposite of a regular calendar spread. It seeks to capitalize on a falling price.

Reverse Calendar Spread With Puts

The “Reverse calendar spread with put” strategy implies that the trader sells a put option with a longer expiration time and buys a put option with a closer expiration time. In this case, the trader seeks to profit from the rising price.

Pros

After getting acquainted with the basic principles of calendar spread strategy trading, we can conclude that this strategy offers the following advantages:

- Limited risk: the maximum potential loss with a calendar spread is limited to the value of the net debit that the trader paid for the strategy. Thanks to this, the trader knows exactly the exact value of potential losses in advance and can manage risks more effectively;

- Flexibility: calendar spreads can be customized to both bull and bear markets, depending on the trader's preference. This makes calendar spread flexible and adaptable to different market conditions;

- Use of Time Value: calendar spreads allow traders to use time value as a factor in generating profits. This is particularly useful in stable or low volatility markets where time value can account for a significant portion of the option price.

Cons

However, the calendar spread strategy has some disadvantages, including:

- Limited profit potential: the calendar spread cannot guarantee high profits if the price of the underlying asset changes significantly;

- Inefficiency in highly volatile markets: if the volatility of the underlying asset or the market as a whole increases, the profit potential may be limited;

- Complexity: the calendar spread is difficult for those who are new to options trading;

- Potential non-performance: in the event of significant movements in the price of the underlying asset, one of the options in the calendar spread will not be exercised, which could result in the loss of the payment for the option.

Risks

Like any other option strategy, calendar spreads are not without risks. One of the main risks is that the price of the underlying asset may deviate too much from the strike price. As a result, the trader will not be able to benefit from the time decay of the short-term option. Moreover, the implied volatility of the longer-term option may also work against the trader.

In addition, an equally significant risk is the possibility of changes in implied volatility, which can lead to losses or reduce the potential profit of the trader.

Also, among the risks:

- Calendar spreads can lose value due to the decay of the time value of a short option position faster than a long option position;

- In the cryptocurrency options market, there may be a risk of lack of liquidity, which may make it difficult to close positions.

Traders should consider these risks when using calendar spreads and take risk management measures, such as using stop-loss orders and limiting risky positions.

Calendar Spread Returns

The profitability of the strategy we review depends on three factors: the difference in implied volatility between the two options, the change in the underlying asset price, and the options’ time decay. Therefore, the strategy will only be profitable if the price of the underlying asset remains stable or trades within a narrow range and there is a significant difference in implied volatility between the two options.

Maximum Take-Profit Potential

The maximum profit of a calendar spread is the net credit received by the trader from the sale of a short-term option.

Maximum Incurred Loss Potential

The maximum potential loss of a calendar spread in options trading is the net debit paid for the spread. Recall that the net debit is the cost of implementing the strategy, which is the difference between the amount paid for the longer-term option and the amount received from the sale of the short-term option.

Calendar Spread Tips

Here are some tips for trading calendar spreads:

- Ensure that both options have sufficient liquidity to ensure uninterrupted execution;

- Choose options with significant differences in implied volatility to maximize strategy profitability;

- Monitor changes in the price of the underlying asset and changes in market volatility to determine what adjustments to make to the strategy;

- Conduct a thorough analysis of the Greeks to determine how changes in the price of the underlying asset and market volatility will affect the profitability of the strategy;

- Use stop loss orders to limit potential losses if the price of the underlying asset crosses a certain level;

- Don't forget that trading options can be risky, so make sure you fully understand all aspects of calendar spreads and their potential risks before you start trading.

Adjustments to Make in Bearish Markets

To adjust the calendar spread in a bear market, the following steps can be made:

- Rolling or buying back of the short-term option.

- Selling of the additional short-term options.

- Rolling of the long-term option.

All of these actions can help manage risk, increase potential profits and limit potential losses.

Alternative Strategies

In cryptocurrency options trading, there are many alternative strategies that can be used instead of or in combination with calendar spreads. Some of them include:

- Vertical Spreads. This strategy involves opening a long and short positions with different strike prices in the same expiration cycle;

- Diagonal spreads. This is a combination of options with different strike prices. This strategy can be used to protect against small movements in the underlying asset price.

- Straddles. This strategy involves buying a call option and a put option with the same strike price and expiration date;

- Butterfly. This is a strategy which involves buying one option, selling two options with higher and lower strike prices and buying another option with an even higher strike price. This strategy can be used when the trader expects the price of the underlying asset to remain about the same.

Final Thoughts

To summarize, a calendar spread strategy is a fairly popular option trading strategy that allows you to profit from the time decay of a shorter-term option while benefiting from the implied volatility of a longer-term option.

This strategy is particularly effective in stable or low-volatility markets where there is a marked contrast in implied volatility between the two options.

And to optimize profits and minimize losses, traders should closely monitor price trends in the underlying asset and remember to adjust the strategy if necessary in the event of any changes.

FAQs

When Should I Buy a Calendar Spread?

You should buy a calendar spread when you expect the underlying asset's price to remain stable or trade within a narrow range and there is a significant difference in implied volatility between the two options.

What’s a Put Calendar Spread?

This is an options trading strategy that involves buying a longer-term put option and selling a shorter-term put option with the same strike price.

How Do You Manage Calendar Spreads?

You can manage calendar spreads by monitoring the underlying asset's price movement and adjusting the strategy if necessary. You should also consider the impact of the Greeks, particularly Delta, Gamma, and Vega, on the strategy's profitability.

How Do I Sell Calendar Spreads?

To sell a calendar spread, you need to have a trading account with an options broker. You can then select the desired options and execute the trade.

What’s the Risk of Calendar Spreads?

The downside risk of calendar spreads is restricted to the net cost of the spread. There is a possibility of incurring losses if the price of the underlying asset moves considerably beyond the options' strike prices or if the implied volatility of the two options is close.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.