Butterfly Spread Option Strategy

What is a Butterfly Spread?

In essence, a butterfly spread is an advanced strategy, deftly leveraging either market volatility or its absence. It encompasses the implementation of a range of options contracts at three separate exercise prices. This specific design aligns seamlessly with traders who possess well-defined expectations of a particular market valuation for the base asset.

Understanding Butterfly Spreads

Butterfly spread may appear quite intricate on the first encounter. As an advanced strategy, it comprises a mix of both long and short contract options. At its core, the strategy aims to exploit either a lack of significant price movement or large price swings. The beating heart of this approach lies in its interplay with volatility and the role of time decay, which differ between the long and short versions of the strategy.

Types of Butterfly Spreads

Butterfly spreads encompass several distinct types, each exhibiting unique characteristics and potential applications. Each type represents a variant of the core butterfly spread strategy, tailored for specific market conditions and trading objectives. Long butterflies thrive in neutral markets, while short butterflies profit in volatile markets.

Deploying The Long Call Butterfly Spread

First in line is the long call butterfly, which includes two long calls, one at a higher and another one at a lower exercise price, and two short calls at a middle exercise price.

The cornerstone rests on the concept of low volatility. In other words, this strategy is designed to capitalize on calm and predictable markets.

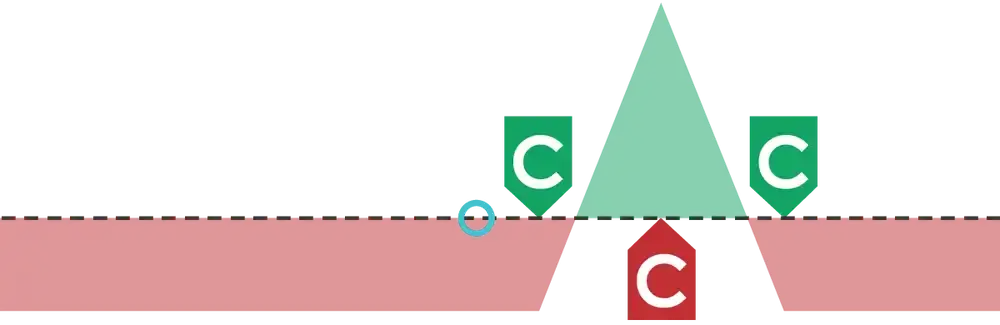

Deploying The Short Call Butterfly Spread

The short call butterfly represents a reversed version of the long call butterfly. It involves two short calls, at a lower and higher exercise prices, and two middle exercise price long calls.

The aim here is to turn increasing market volatility into a profit-making opportunity.

Deploying The Long Put Butterfly Spread

The long put butterfly is repeating the long call spread, only with put options. It is designed to reap benefits in a low volatility environment, too. In short, it encompasses two long puts (at a higher and at a lower exercise prices), and two short puts at a middle exercise price.

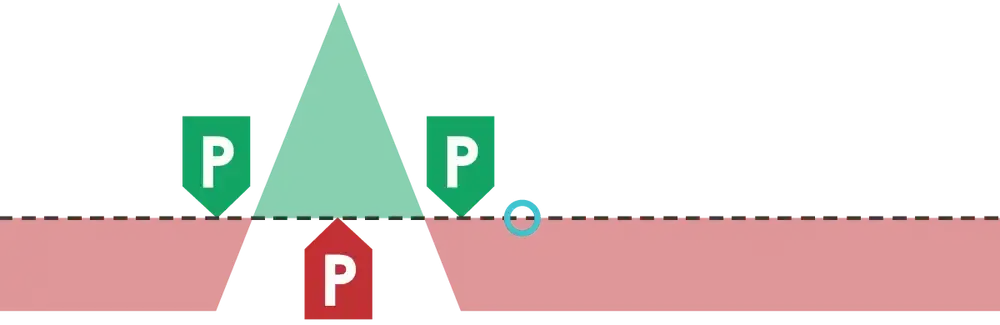

Deploying The Short Put Butterfly Spread

Its counterpart, the short put butterfly spread, includes two short puts at a lower and higher exercise prices plus two long calls at a middle exercise price.

This strategy is used by traders who anticipate a surge in market volatility and aim to capitalize on it.

Iron Butterfly Spread

Next in line is the iron butterfly spread. It is a blend of a bull call spread and a bear put spread. The setup involves selling a call and a put at identical exercise prices, typically at-the-money. Simultaneously, a trader is buying a call and a put at higher and lower exercise prices, respectively. More about it you can learn from our in-depth article.

Reverse Iron Butterfly Spread

As the name implies, this strategy is a mirror reflection of the iron butterfly spread. It involves buying a call and a put contract at the same exercise price (usually at-the-money), while concurrently selling another call and a put at higher and lower exercise prices, respectively. This strategy is a prime candidate for volatile market environments.

Setting Up Butterfly Options

It’s important to remember that, regardless of the type of butterfly spread, the positions should be opened at three distinct exercise prices. The exercise prices are typically equidistant from each other and ideally centered around the expected price of the base asset at the expiry.

For instance, using Bitcoin as our base asset, if a trader expects the price to hover around $20,000 at the expiry date, they might set up their butterfly spread with strikes of $19,000, $20,000, and $21,000. Thus, the trader can benefit from minimal changes in Bitcoin's price while limiting their downside risk.

Managing Butterfly Options Strategy

Effective oversight of a butterfly spread hinges on monitoring the price of the base asset, time decay, and market volatility. Adjusting spread may be required if the asset's price nears the boundaries of the butterfly or as the expiry nears.

Volatility shifts also demand attention, as they affect the profitability of long and short butterfly spreads differently. Ultimately, constant vigilance and strategic adjustments help optimize returns and curtail potential losses in managing a butterfly options strategy.

Market Outlook for Implementing the Butterfly Spread

The butterfly spread isn't solely the territory of seasoned traders. It appeals to a broad spectrum of market participants, from novices finding their footing in options trading to veterans looking to employ advanced trading strategies. However, what's vital is having a comprehensive understanding of options, their pricing, and the intricacies of market dynamics.

For traders anticipating minimal price movement in the base asset within a given time frame, the long butterfly spread presents itself a potent strategic instrument. It allows setting up a trade with defined risk parameters, maximum potential profit and loss.

On the other hand, if you foresee substantial price volatility, the short butterfly spread can be useful. It allows you to take advantage of big price swings while also having a limited downside, protecting you from excessive losses.

Market Conditions for Using The Butterfly Spread

This strategy shines under multiple market conditions. For instance, the long butterfly is typically utilized when market sentiment indicates a lack of strong price movement — where minor price fluctuations are anticipated around a specific price level.

In stark contrast, the short butterfly becomes a powerful weapon when the base asset is projected to experience substantial price changes in either direction. This type of butterfly spread can yield substantial returns during periods of heightened volatility.

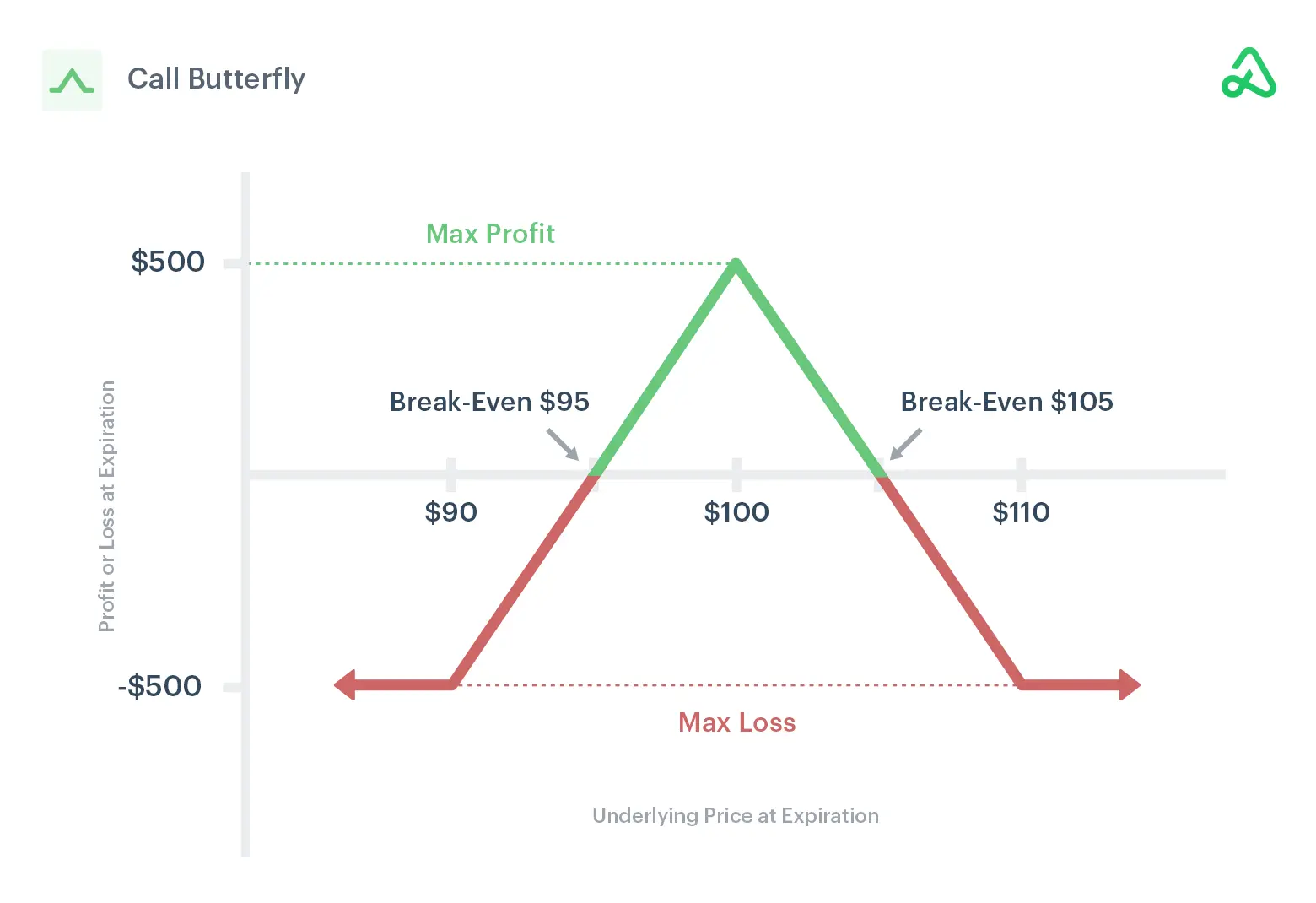

The Point of Breaking Even

In a standard long butterfly spread, there are two equilibrium points. The lower break-even point is the sum of the lower exercise price and the net premium paid. Conversely, the upper break-even point is derived by subtracting the net premium paid from the higher exercise price.

Maximum Profit Potential

Speaking of a long butterfly spread, the maximum profit potential is attained when the base asset's price perfectly aligns with the middle exercise price upon the expiry. In order to calculate the maximum potential gain, we need to subtract the net premium paid from the difference between the middle and lower exercise prices.

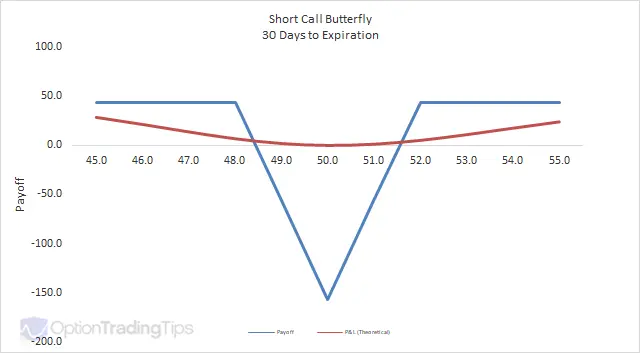

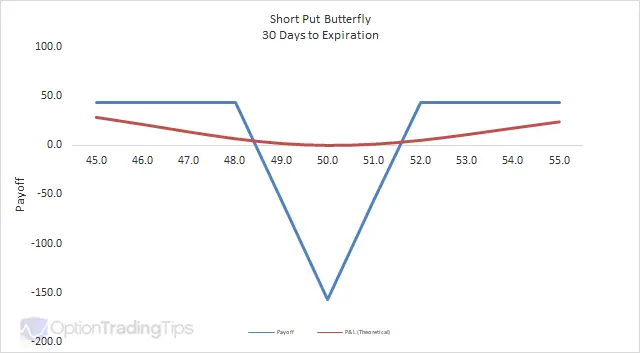

In contrast, for a short butterfly, the peak profit potential is essentially the net credit garnered upon the position setup. It is realized when the base asset’s price exhibits substantial deviation from the central exercise price.

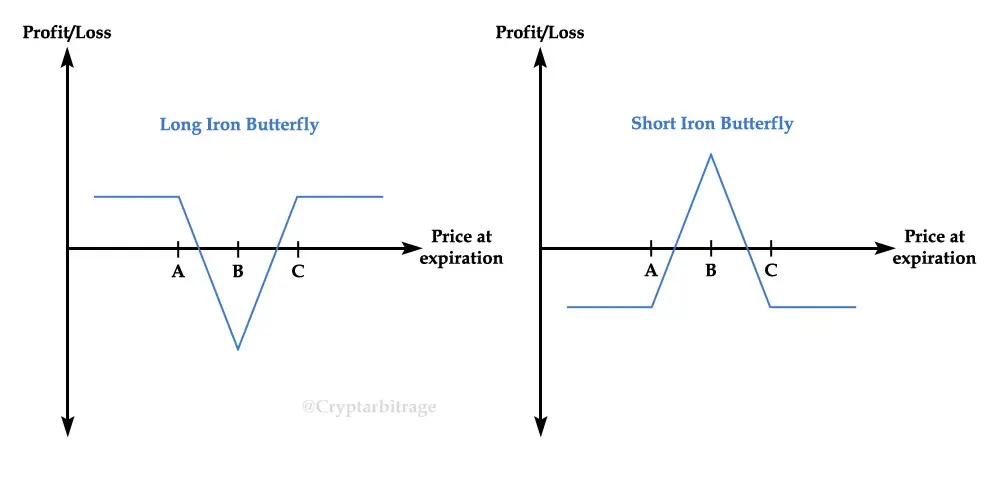

If our three options are A, B, and C, then the profitability charts for long and short butterfly spreads will look as following:

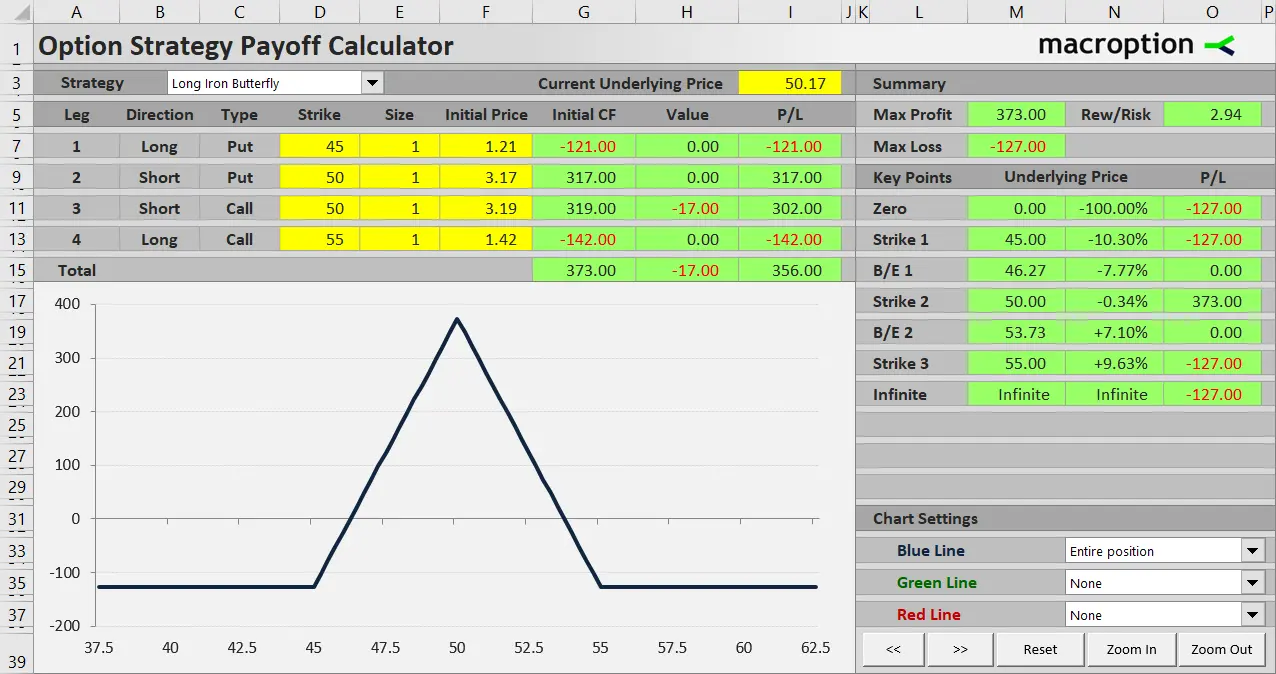

There are various online tools for calculating options’ strategy profitability. Alternatively, traders handy with Excel can make their own butterfly spread payoff table. A typical table will look as follows:

Maximum Incurred Loss Potential

As for the long butterfly spread, the maximum potential loss for the strategy is limited to the net premium expended to establish the strategy. This loss is encountered if the base asset's price at the expiry date is either below the lower or above the higher exercise price.

Conversely, within a short butterfly spread, the maximum potential loss is the middle exercise price minus either of the other exercise prices and the net credit received. This loss is faced if the base asset's price ends up at the middle exercise price upon the options’ expiry.

Example

Venturing into a practical illustration, consider the volatile world of cryptocurrency options trading, where Bitcoin currently holds a value of $20,000. Our focus would be to execute a long call butterfly spread, in the following manner:

- Buy a call at a lower exercise price of $19,000, costing a premium of $1,500.

- Sell two calls at the middle exercise price of $20,000, each one drawing a premium of $1,100, amassing a total premium of $2,200.

- Buy another call contract at a higher exercise price of $21,000, for which a premium of $700 is paid.

Here, the total premium outflow is $2,200 ($1,500 for the lower strike call and $700 for the higher strike call), which is balanced by the $2,200 premium inflow from the middle strike calls sold, initiating the spread without any net debit or credit.

Let's proceed to expiry. If Bitcoin hovers precisely at the $20,000 strike price, the max profit of $1,000 would unfold. How? The two short calls at $20,000 become worthless, and the trader pockets the $2,200 premium received. The long call at $19,000 ends in-the-money, carrying an intrinsic value of $1,000. But remember, a $1,500 premium was paid for this option, leading to a net loss of $500 on this leg. Moreover, the long call at $21,000 expires worthless, resulting in a loss of $700 – the premium paid for it.

Tallying these figures, the max profit calculates to $2,200 (premium received) – $500 (loss on the $19,000 call) – $700 (loss on the $21,000 call), which is equal to $1,000.

In case Bitcoin's price ventures outside the $19,000 - $21,000 range at expiry, all options turn worthless. The max loss incurred, then, would be equal to the net debit paid to set up the spread, which, in this scenario, is zero, excluding any transaction costs or fees.

Trading Butterfly Options

Tips

A few tips can make trading butterfly spreads smoother. Firstly, traders need to anticipate the base asset's price with high precision. Secondly, consider transaction costs, as they can add up due to the multiple trades involved in setting up a butterfly spread. Lastly, timing is crucial, as these options will yield the maximum profit if held until the expiry.

Benefits

Despite the complexity, trading butterfly options offers several benefits. The strategy provides traders with a high reward-to-risk ratio. The potential losses are limited to the net premium paid for the options. Plus, it's an excellent tool for profiting from a relatively stable market.

Risks

However, trading butterfly options is not devoid of risks. The strategy requires a precise prediction of the price at the expiry, which can be challenging. It also involves higher transaction costs due to multiple trades. Moreover, while the losses are capped, they are still likely if the price moves significantly away from the middle strike price.

In a Nutshell

Trading the butterfly spread options is a complex yet rewarding strategy for traders who can accurately anticipate the price of an base asset. While the potential losses are capped, a precise forecast is required to maximize the profits. With adequate knowledge and careful planning, traders can capitalize on the opportunities presented by the butterfly spread strategy.

FAQ

What Is A Butterfly Spread In Options Trading?

A butterfly spread is a sophisticated strategy used in options trading. Its main feature is that positions are opened at three different exercise prices. The strategy is designed to harvest maximum profits when the price of the base asset predominantly hovers near the median exercise price.

Can A Butterfly Spread Strategy Be Used For Bitcoin Options Trading?

Yes, a butterfly spread can be used in Bitcoin options trading. It can be particularly effective when the trader anticipates minimal price movement in Bitcoin. However, due to Bitcoin's often high volatility, a thorough analysis should be made prior to making any forecast and establishing the strategy.

What Are The Risks Involved In A Butterfly Spread Strategy?

A butterfly spread involves risks such as precise price prediction at expiry and potentially higher transaction costs due to the multiple trades involved.

How Does The Volatility Of Bitcoin Affect A Butterfly Spread Strategy?

The volatility of Bitcoin can significantly impact a butterfly option strategy, as generally the strategy thrives in a low-volatility environment. However, variations of the strategy, such as the short call or short put butterfly spreads, can profit from high volatility.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.