Bond Market Pain

Crypto Market Week in Review (04 August, 2023)

Markets

This week, markets shifted into a risk-off mode. The pivotal news of the week was a credit downgrade of the US by Fitch, which sparked a drop in both stock and bond prices. Fitch stated, "The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to 'AA' and 'AAA' rated peers over the last two decades. This erosion has manifested in repeated debt limit standoffs and last-minute resolutions." However, we believe that this news served more as an excuse for the market movements than as a real cause. The true cause appears to have been a liquidity outflow due to heavy bond issuance by the US Treasury.

Stocks declined, with technology stocks underperforming. However, the real pain was seen in the bond market, where bond prices plunged and long-term securities were hit the hardest. The 10-year Treasury yield rose above its maximums for the year, reaching its highest level since November 2022. Intriguingly, despite the significant spot movement, implied volatility for Treasuries remained near the bottom of its recent range.

10-year Treasury yield and MOVE index (Treasuries implied volatility)

Cryptocurrencies remained largely unaffected by the bond market's drop. Both Bitcoin and Ethereum were nearly flat compared to last Friday's close, while Litecoin declined by 6% despite a halving event that occurred this week.

Several asset management companies submitted applications to launch an ETF based on Ethereum futures. This ETF would be similar to the already existing Bitcoin futures ETFs, such as the ProShares Bitcoin Strategy ETF (BITO). We are curious to see whether US regulators will find any reasons to oppose this ETF proposal.

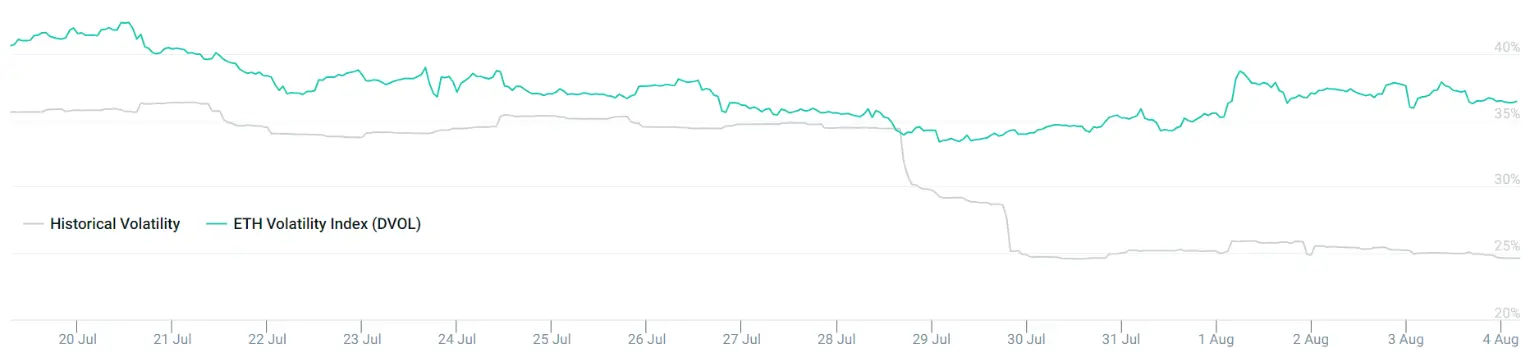

The implied volatility of both Bitcoin and Ethereum remained largely unchanged this week, continuing to hover near all-time lows. However, Ethereum's implied volatility surpassed Bitcoin's (as measured by DVOL indexes), and Ethereum option open interest has almost recovered following the end-July expiration. This contrasts with Bitcoin option open interest, suggesting an increased demand for Ethereum volatility. While Ethereum's historical volatility continued its decline, its implied volatility has stabilized.

Ethereum historical and implied volatility (as measured by DVOL)

This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.