Arbitrage Trading: All You Need to Know

The world of arbitrage trading in crypto can be confusing and overwhelming to understand because of the technology involved. However, it has appeared as an alternative way to profit from the crypto market, one best suited for institutional buyers.

Crypto arbitrage trading has been gaining traction as it provides a means of profiting from price differences between crypto exchanges. We'll help you understand this new frontier called crypto arbitrage trading with our beginner's guide!

Arbitrage Explained: How Does Arbitrage Work?

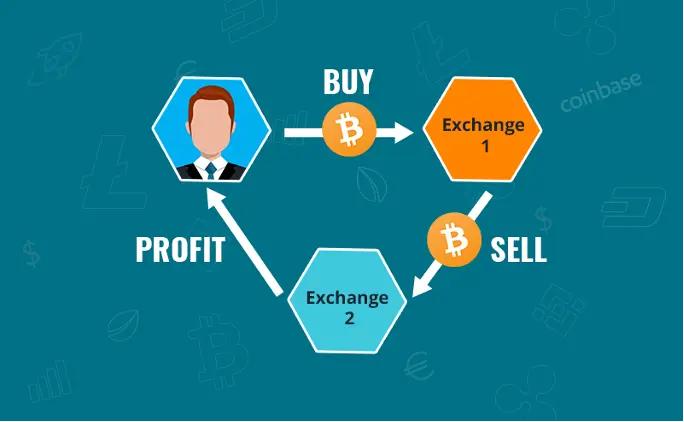

Arbitrage is often used in investment circles and is best explained as the purchase of an asset in one market to be sold immediately for a profit in another market at a higher price. Applied to the world of cryptocurrency, cryptocurrency arbitrage opportunity could mean buying low on one exchange and selling it high on another.

This price discrepancy can be caused by various factors, including differences in supply and demand, trading volumes and even regional regulations on different exchanges. Due to these factors, crypto arbitrage opportunities abound for savvy investors looking to exploit investment possibilities. For example, if you used US dollars to buy bitcoin on exchange A for a lower price, then you sold that bitcoin on exchange B, you would make money instantly.

However, it is important to note that despite the simplicity of the concept, it can be quite complex in practice. Factors such as transaction fees, transfer times, market volatility can affect the profitability of arbitrage strategies over a period of time. Therefore, it requires careful planning, real-time monitoring and a thorough understanding of the cryptocurrency market.

How to Arbitrage Bitcoin

Different exchanges have different customers, and the way they organize markets may vary. The main reason bitcoin arbitrage happens is that crypto exchange prices move independently, especially during high volatility events.

As for the phenomenon, it is usually so fast that you might not get the best from it trading yourself. Speed of execution is crucial in this case. However, you can avoid missing opportunities to profit on the bitcoin price differences by using a bot.

Speed of execution is crucial to profit from the Bitcoin arbitrage trading strategy. The common way to benefit from crypto arbitrage opportunities is by using a high-frequency trading technology that spots opportunities and executes orders faster than the competitors.

You can also get a flash loan to make the most of it; just one caveat. Your bot is in stiff competition with many other high-frequency trading bots. With the super tech, crypto arbitrage strategies tend to be always profitable—provided that one properly hedges the underlying.

For traders without the tech stack, there might still be more complex arbitrage strategies that involve extra structuring via several trading instruments—say, buying Grayscale BTC trust and arbing via derivates to be delta neutral while leveraging GBTC discount.

Types of Crypto Arbitrage

Now, let’s briefly see the types of strategies exploiting the price differences in crypto. Each of them comes with different mechanisms. Popular ones include cross-exchange transactions and spatial arbitrage, and we will take a closer look at the others.

Cross-Exchange

Cross-exchange arbitrage is a specific strategy that involves taking advantage of price differences between two or more different exchanges. In the context of cryptocurrency, it refers to buying a digital asset on one exchange where the price is low and then selling it on another exchange where the price is higher.

Here's how it typically works:

- Identify opportunity: identify a cryptocurrency that is priced differently on two exchanges, exchange A and exchange B.

- Buy low: buy the cryptocurrency on exchange A, where the price is lower.

- Transfer: the cryptocurrency is transferred from exchange A to exchange B. This step may involve waiting for network confirmations and can vary in time depending on the cryptocurrency and network congestion.

- Sell high: once the cryptocurrency is received on exchange B, sell it at the higher price.

- Profit: the difference between the buying and selling price, minus any transaction fees, transfer fees, and potential taxes, is the profit.

Cross-exchange strategy can be lucrative, but also comes with challenges and risks. Price differences may quickly disappear, transfer times can be unpredictable, and fees may eat into profits. Additionally, liquidity constraints might prevent the execution of large trades without significantly impacting the market price.

Many traders use automated bots to execute cross-exchange trades as they can react to price differences more quickly than a human. However, even with automation, a deep understanding of the market and careful consideration of the associated risks and costs is essential to take advantage of the prices differences on different exchanges.

Spatial

The cross-exchange and spatial arbitrage strategies are very similar. The only noticeable difference between them is that, in spatial arbitraging, the exchanges come from different regions of the world. A trader can easily capitalize on differences in the supply and demand of Bitcoin in the United States and South Korea using a spatial arbitrage method.

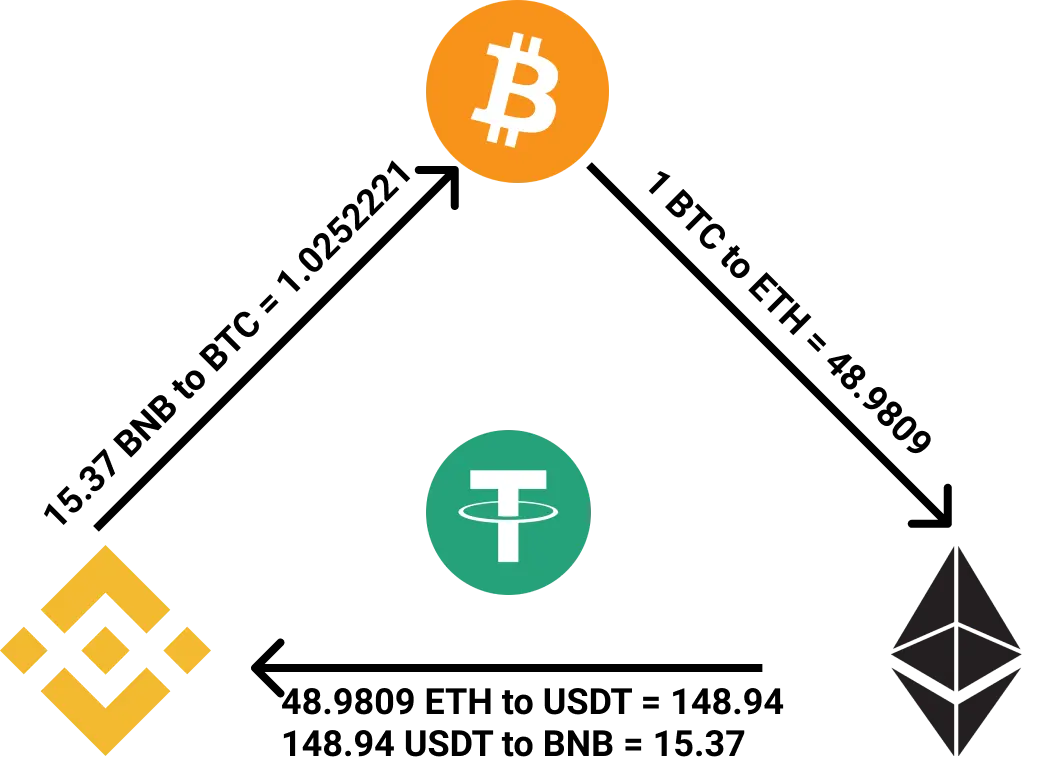

Triangular

Triangular arbitrage in the cryptocurrency world involves three trades, usually on a single exchange, where a trader exchanges an initial cryptocurrency for a second, the second for a third, and then the third back to the initial cryptocurrency. The goal is to exploit discrepancies in the exchange rates between the three cryptocurrencies to end up with more of the initial cryptocurrency than started with, minus any trading fees. It's a complex strategy that requires real-time monitoring, understanding of the market, and careful execution, often aided by automated trading algorithms.

Decentralized

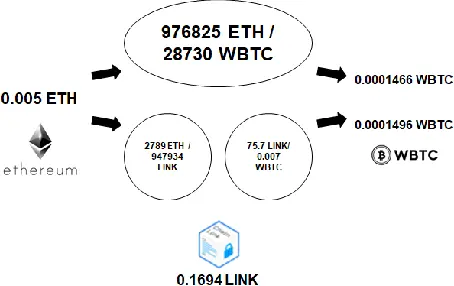

When you use arbitrage on smart contracts or automated market makers (AMMs), it is called decentralized arbitraging. For example, once the price of the crypto pairs differs from their spot price on centralized exchanges, a Bitcoin futures arbitrage trader can execute cross-exchange trade that involves centralized and decentralized exchanges.

Statistical

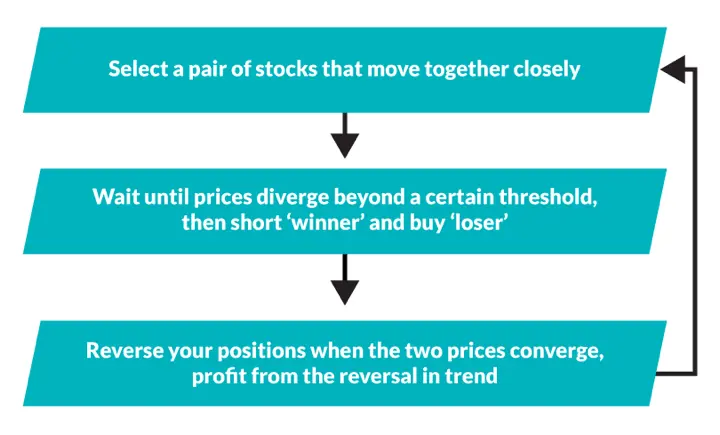

Statistical arbitrage in cryptocurrency involves using mathematical models and algorithms to identify temporary price spreads between related assets. By analyzing historical data and statistical relationships, traders execute simultaneous buy and sell orders to profit from the expected convergence of the price discrepancy. It's a complex, low-risk strategy often used by institutional investors and professional traders, requiring sophisticated tools and deep understanding of market behavior.

Tips for Successful Crypto Arbitraging

Cryptocurrency arbitraging is a great way to make extra cash, but it isn't a simple task. With that in mind, here are tips for successful Bitcoin arbitraging:

Have a Strategy

Having a well-defined strategy is a hallmark of successful trading, and it's what often separates amateurs from professionals. A strategy not only guides your trading decisions but also helps you navigate the complexities and risks inherent in the market.

- Understanding your trading style. Your strategy must align with your trading style, risk tolerance, and investment goals. Whether you're a day trader looking for quick profits or a long-term investor seeking steady returns, your strategy must reflect your approach.

- Exploring different strategies. There are various strategies one can employ in crypto arbitrage. One popular example is the cash-and-carry strategy. This market-neutral strategy aims to exploit mispricings between the spot and derivatives market prices of a cryptocurrency. Here's how it works:

- Buy spot: buy a long position in a cryptocurrency (like Bitcoin) in the spot market.

- Sell futures: simultaneously, sell a futures contract for the same amount of cryptocurrency.

- Hold until expiry: hold both positions until the futures contract expires.

- Profit from the difference: the profit comes from the difference between the spot price and the futures price at the time of the futures contract's expiration.

- Considering Risks. While strategies like cash-and-carry can offer relatively stable profits, they are not without risks. Concerns like credit risk, market volatility, and potential changes in regulations must be considered. A comprehensive risk management plan should be part of any trading strategy.

In conclusion, having a well-defined and carefully considered strategy is paramount when one is going to profit from the difference in bid-offer spreads. It requires understanding various trading techniques, utilizing technology like trading bots, considering potential risks, and being adaptable to market changes.

Use a Reliable Arbitration Bot

Speed is a vital part of cryptocurrency arbitrage, and as such, the race for a better bot is never-ending. Crypto arbitrage traders use bots, which are essential for front-running and for anyone looking to profit off-price discrepancies. They automate the process of finding and executing trades, making them much faster and more accurate than humans. However, not all bots are created equal. Some are more reliable than others, so it's important to do your research and choose (or build) a bot that you can trust.

Merits and Demerits of Crypto Arbitraging

Not dependent on market cycles

One of the major pros of arbitrage trading is that you can profit regardless of Bitcoin’s price direction. So even if it's decreasing, you can still make money. This characteristic makes crypto arbitraging ideal for investors who want to maintain steady profits and don't want to tie themselves down to one investment strategy. Also, you can exploit the difference in prices in bitcoin futures, leveraging the liquidity pools and spreads available in the market.

Crypto Never Sleeps

Major cryptocurrencies are also rather liquid assets with 24-hour buy/sell markets. Compared to other investments such as stocks and foreign exchange markets, which are limited to trading hours. This means that you can move capital out of cryptocurrencies at any time, which might contribute to the crypto market growth.

The Risks of Crypto Arbitrage

It’s possible to structure crypto arbitrage to bear very little risk. However, when done improperly, there are several potential dangers that you should be aware of before attempting this strategy.

Different Levels of Liquidity

The downside is that hundreds of cryptocurrencies are available for investing today, and each has different levels of liquidity. Therefore, to succeed in cryptocurrency arbitraging, especially Bitcoin arbitrage, traders must understand how each currency works (its purpose) and how its price will react under different market scenarios.

Losses

Another risk you may face is the potential for losses due to price swings. While this can be mitigated by using stop-loss orders, there’s always the possibility that a currency will drop in value so rapidly that your stop-loss order gets executed at a price lower than you anticipated, leading to a loss.

Capital at Risk

There are many risks associated with crypto-arbitrage trading strategies—but perhaps one of the biggest is the risk that comes from trading across several exchanges simultaneously; it can be difficult to cover losses if you make an error or have bad luck on one exchange.

Investors may expose themselves to too much risk by buying cryptocurrencies on one exchange, selling them for a profit at another, and then attempting to withdraw their funds while still awaiting approval from another platform.

Remember: It's never wise to invest more than you're willing to lose—and with crypto arbitrage trading, there's plenty of opportunity for loss due to sudden dips or spikes in price.

Market Manipulation

If market manipulation occurs, arbitrageurs' activities can be disrupted. For example, suppose a large institutional investor decides to sell a large amount of a certain token all at once. In that case, this can invariably affect the price of that token and make it difficult for arbitrageurs to profit from price differences between exchanges. In contrast, if a group of traders or top crypto twitter influencers conspire to drive up the price of a certain token on one exchange, this can create an imbalance that arbitrageurs can exploit to buy low on one exchange and sell high on another.

Transaction Costs

The transaction costs required to participate in Bitcoin arbitrage can add up quickly. These costs include trading, deposit, and currency conversion. Exchange fees also play a significant role in determining the profitability of a trade.

Each of these costs makes it more difficult for a trader to come out ahead after making trades in an attempt at crypto arbitrage. Because of these factors, many traders often lose money with each trade they make.

Taxes

As cryptocurrency becomes more and more mainstream, governments worldwide are trying to wrap their heads around how they can collect taxes on crypto transactions. Unfortunately, if you're participating in arbitrage trading in crypto, there are some dangers associated with it—including not paying all your required taxes.

For example, a US District Court judge recently issued an injunction against Coinbase that requires it to turn over user transaction records to US tax authorities. It will be interesting to see if other exchanges face similar pressures.

Is Arbitrage Trading in Crypto Worth It?

Arbitrage is a way to take advantage of price discrepancies across different markets, whether stocks or currencies. However, arbitrages can become more complicated in the case of cryptos because they don't follow similar pricing conventions as equities and bonds, which are tied to company performance, etcetera. This variability can provide unique opportunities for diversifying your portfolio.

However, profiting from the price differences can become more complicated in the case of cryptos because they don't follow similar pricing conventions as equities and bonds, which are tied to company performance, etcetera. As a result, there are potential high rewards and significant risks involved if you're unaware. It's crucial to consider how these strategies can impact your portfolio.

As with any investment strategy, conducting in-depth research is essential when exploring cryptocurrency arbitrage; this involves using software and evaluating different cryptocurrencies to track exchanges in real-time.

If you're looking for an opportunity with crypto trading, consider using the strategies explained above as one viable tool in your arsenal. It may not always provide a profit, but it does have potential and, if done correctly, can result in some real success stories.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.